GLOBAL AIR SEEDER MARKET (2024 - 2030)

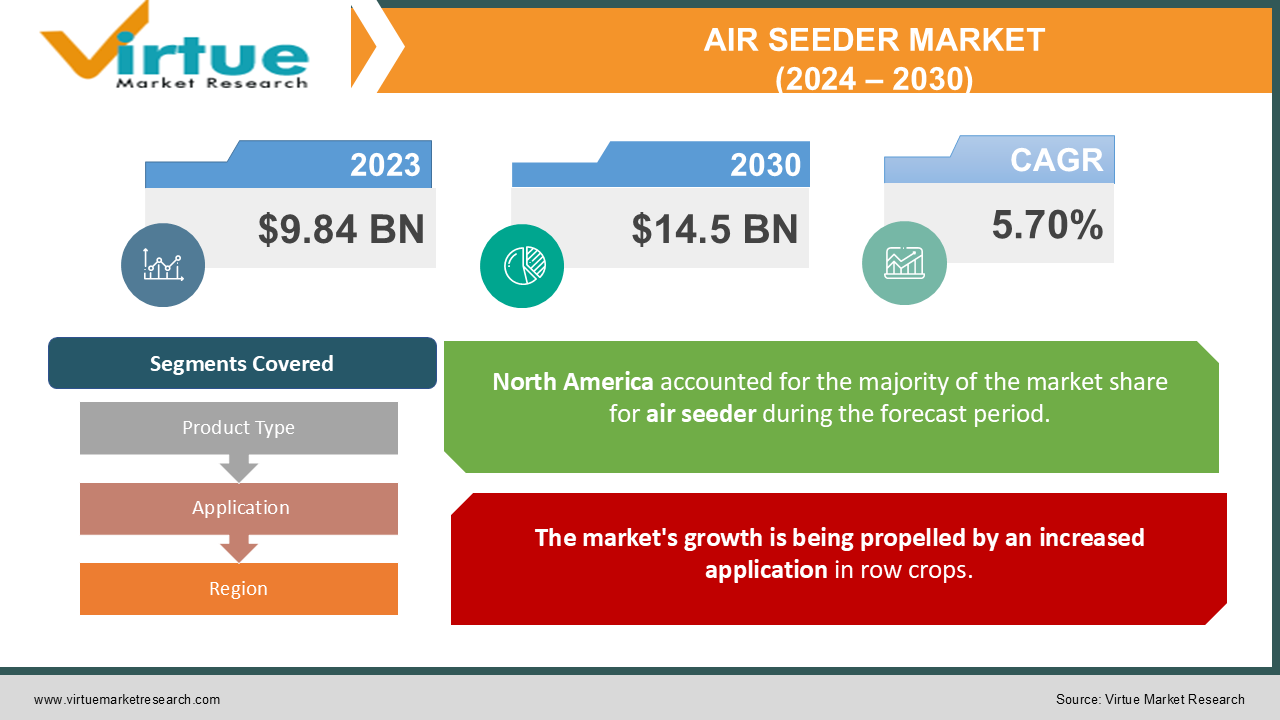

The Global Air Seeders Market USD 9.84 Billion in 2023 and is projected to witness lucrative growth by reaching up to 14.5 USD Billion by 2030. The market is expected to exhibit a CAGR of 5.70% during the forecast period (2024-2030).

Air seeders possess a distinct advantage over alternative sowing equipment, capable of efficiently planting thousands of seeds per minute with precise and even distribution. This not only saves considerable time but also reduces labor requirements during the seeding process. Recognized as essential agricultural equipment, seeders enable the simultaneous planting of multiple seeds in the soil. The choice of seeders in agriculture depends on the specific farm type and size. Drills, a type of seeder, offer numerous advantages, including user-friendly operation, low maintenance, easy equipment connection, high efficiency, and cost-effectiveness. They are versatile, accommodating both seeds and fertilizers. Presently, manufacturers are prioritizing the development of technologically advanced sowing equipment, aiming for reduced maintenance requirements. Air seeders, primarily designed for sowing small round seeds, stand out due to their advantageous features. Not only do they facilitate easy transport and demand minimal maintenance, but they also fertilize during the planting process. Given these considerations, the expansion of air seeders is expected to drive the market in the forecast period. The future prospects for the air seeder market appear promising, fueled by the imperative need to enhance agricultural productivity amid the growing global population and heightened food demand.

Key Market Insights:

- The Air Seeders Market is experiencing a strong upward trend, leveraging advanced agricultural technology. These precision seeding machines are distinguished by their capability to sow thousands of seeds per minute, leading to substantial reductions in time and labor costs.

- Recent market data highlights the versatility of air seeders, adeptly managing both seeds and fertilizers. Manufacturers are actively involved in pioneering innovations, crafting highly advanced models with minimized maintenance requirements.

- Significant crop production figures in 2022, as reported by USDA, reveal 15.1 billion bushels of corn, 448 million bushels of sorghum, and 4.44 billion bushels of soybeans, underscoring the crucial role played by air seeders.

- With the global population's continuous increase driving heightened food demands, the air seeders market is well-positioned to address the growing need for improved agricultural productivity.

Global Air Seeders Market Drivers:

The market's growth is being propelled by an increased application in row crops.

The global growth of the air seeder market is anticipated to be driven by the escalating adoption of advanced agricultural technology in machinery. This includes the integration of automatic seeders, which contribute to a reduction in both sowing costs and time, while simultaneously enhancing the precision of farming practices. The proliferation of small and medium-scale industries involved in the manufacturing of agricultural machinery is projected to further augment the global air seeder market. These machines find extensive use in the sowing of row crop seeds, such as cotton, corn, sunflower, soybean, and other legumes. According to the USDA's Crop Production 2021 Summary report, corn production was estimated at 15.1 billion bushels, sorghum at 448 million bushels, and soybean at 4.44 billion bushels.

Global mechanisation is projected to drive the air seeder market.

Increasing mechanisation in emerging countries is predicted to drive the air-seeder market in the coming years. The scarcity of water, land, and labour has accelerated the rate of farm mechanisation in emerging countries. agricultural mechanisation accounts for 50-60% of agricultural mechanisation in developing nations such as China and India, whereas it is more than 95% in industrialised countries such as Japan and the United States in 2022. With every 1% increase in mechanisation, total crop yields, grain crop yields, and cash crop yields increase by 1.2151, 1.5941, and 0.4351%, respectively.

Global Air Seeders Market Restraints and Challenges:

The large capital investment required for air seeders is predicted to provide obstacles to the market's growth.

The significant initial costs linked to obtaining and executing air seeder technology could potentially impede its extensive implementation. The cost of an air seeder can vary greatly, from tens of thousands to hundreds of thousands of dollars, based on the machine's complexity and size. Because of this, investing in this technology may be challenging for smaller farmers or those with tighter finances. Owning and using an air seeder has recurring expenses in addition to the initial high cost. These expenses include upkeep, repairs, and fuel or power expenditures. These continuous costs can mount up quickly and serve as an additional barrier to farming for some farmers. This precision seeding equipment’ high capital requirements could turn off potential customers, which would change the dynamics of the market as a whole. It is recommended that stakeholders and industry participants employ competent strategic planning in order to manage and address these financial restrictions.

The war between Russia and Ukraine could hinder market expansion.

The market for air seeders in the area has been significantly impacted by the ongoing conflict between Russia and Ukraine. Major agricultural products produced in Ukraine include wheat, maize, and sunflower seeds. To increase crop yields, farmers in the nation mostly rely on contemporary farming equipment, such as air seeders. A lack of farm equipment, particularly air seeders, has resulted from the fighting, which has also interrupted agricultural productivity.

Global Air Seeders Market Opportunities:

The air seeders market is full of international opportunities that offer a conducive environment for development and innovation. A favourable atmosphere for market expansion is produced by the growing use of precision seeding methods and cutting-edge agricultural technology. Manufacturers who are investigating cutting-edge models with improved functionality and lower maintenance needs stand to gain success. The market for air seeders is leading the way in fulfilling the need for increased agricultural output as the world's population continues to rise and drive up food demand. Strategic players might take advantage of these chances to carve out a sizable position in a market driven by the imperative demand for new, effective farming methods.

GLOBAL AIR SEEDERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.70 % |

|

Segments Covered |

By Product Type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SEED HAWK, CNH Industrial, John Deere Morris Industries Ltd., Amity Technology Gandy Company, Thebo Tech, Great Plains AGCO Corporation, Bourgault Industries. |

Global Air Seeders Market Segmentation:

Market Segmentation: By Product Type

- Front Mounted Bins

- Rear Tow Seeder Bins

By product type, rear tow seeder bins held the maximum market share in 2023 and were the most widely available product type owing to the rear tow seeder bins offering a wide variety of functionalities which include an easy way for sowing as it comfortably fits machinery and is easy to handle for farmers. Another main reason for their popularity is their versatility and flexibility. In the meantime, Front Mounted Bins emerge as the product category with the quickest rate of growth throughout the projected timeframe. Their cutting-edge qualities and functionalities place them in a position to be a major force behind market growth, satisfying the changing demands of farmers all over the world.

Market Segmentation: By Application

- Corn

- Wheat

- Rice

- Soybean

- Cotton

- Canola

- Others

Due to wheat farming's higher acceptance rate of new technology than any other crop, wheat application is predicted to hold the biggest market share in the global market. The second-largest agricultural land area worldwide was cultivated wheat. 779.33 million tonnes of wheat were produced in 2022. 780.59 million tonnes of wheat are expected to be produced worldwide in 2023, a potential rise of 1.26 million tonnes or 0.16%. Furthermore, Wheat is the application that is expected to expand the fastest during the projection period, indicating an increasing preference for air seeders in order to optimise wheat cultivation practises.

Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Because of its widespread use of precision farming technologies and sophisticated agricultural practises, North America emerges as the market's greatest provider. The area is at the forefront of the global air seeders market thanks to its well-established farming infrastructure and technical breakthroughs. As for the fastest-growing region, Asia-Pacific steals the show thanks to an increase in agricultural activity, changing farming techniques, and rising public knowledge of the advantages of air seeders. The Asia-Pacific region is expanding quickly, which indicates a revolution in agricultural practises and an increase in the need for cutting-edge seeding methods. China's Ministry of Agriculture reports that automated mechanical harvesters are used to sow more than 70% of the country's 80.0% of wheatland.

COVID-19 Impact Analysis on the Global Air Seeders Market:

The coronavirus pandemic has a significant influence on the agricultural sector, and the lockdown put in place to block the spread of COVID-19 will have a significant impact on the operation of the seed industry and its affiliates. China, the United States, Germany, France, the Netherlands, France, Italy, Spain, Brazil, India, and other major seed-producing nations are all affected by the coronavirus. As a result, there may be a significant discrepancy between supply and demand for seeds coming into the upcoming planting season. High-value seeds would face a far wider disparity between supply and demand, particularly for those of specific fruit and vegetable kinds grown in European nations. International organisations would concentrate more of their efforts and strategies on rich countries than on developing and impoverished ones, as the impact of COVID-19 is far higher in these nations. On the other hand, delays in the delivery of seeds produced in other provinces were one effect of the closure on the seed and related sectors.

Latest Trends/ Developments:

- John Deere, a producer of agricultural equipment, unveiled the p600 series, a recently updated range of precision air hole drills that is specifically tailored to appeal to small grain growers. The drills were released in July 2022.

- Lemken purchased Equaliser, a well-known seed drill manufacturer with headquarters in Cape Town, in January 2023 in order to grow its operations in the southern hemisphere.

- Because it's more than just an update or improvement, the Morris Quantum Air Drill isn't referred to as the C3 Contour. The product in question is the next generation of pneumatic seed drills, brimming with innovations and technology that will shape the direction of future product development within our range.

- AGCO, Your Agriculture Company (NYSE: AGCO), a multinational producer and distributor of agricultural machinery, declared today that it and Amity Technology, LLC have inked a memorandum of intent to establish a joint venture aimed at developing and distributing Pneumatic Seeding Equipment and tillage.

Key Players:

- SEED HAWK

- CNH Industrial

- John Deere

- Morris Industries Ltd.

- Amity Technology

- Gandy Company

- Thebo Tech

- Great Plains

- AGCO Corporation

- Bourgault Industries.

Chapter 1. GLOBAL AIR SEEDER MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL AIR SEEDER MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL AIR SEEDER MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL AIR SEEDER MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL AIR SEEDER MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL AIR SEEDER MARKET – By Product Type

6.1. Front Mounted Bins

6.2. Rear Tow Seeder Bins

Chapter 7. GLOBAL AIR SEEDER MARKET – By Application

7.1. Corn

7.2. Wheat

7.3. Rice

7.4. Soybean

7.5. Cotton

7.6. Canola

7.7. Others

Chapter 8. GLOBAL AIR SEEDER MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Product Type

8.1.3. By Applications

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Applications

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By Applications

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By ProductType

8.4.3. By Applications

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By Applications

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL AIR SEEDER MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. SEED HAWK

9.2. CNH Industrial

9.3. John Deere

9.4. Morris Industries Ltd.

9.5. Amity Technology

9.6. Gandy Company

9.7. Thebo Tech

9.8. Great Plains

9.9. AGCO Corporation

9.10. Bourgault Industries.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global Air Seeders market size is valued at USD 9.84 billion in 2023.

The worldwide global Air Seeders market growth is estimated to be 5.70% from 2024 to 2030.

The global Air Seeders market is segmented by Product Type (Front Mounted Bins, Rear Tow Seeder Bins), by Application (Corn, Wheat, Rice, Soybean, Cotton, Canola, Others).

In response to the growing need for precision agriculture solutions, future trends in the worldwide air seeders market may include improved technological developments, a rise in the adoption of sustainable farming practises, and expanded prospects in emerging nations.

The global market for air seeders was interrupted by the COVID-19 epidemic, which resulted in supply chain issues, production delays, and demand effects. Still, the sector proved resilient, recovering gradually as agriculture remained a vital business.