GLOBAL ADULT DIAPERS MARKET (2023 - 2030)

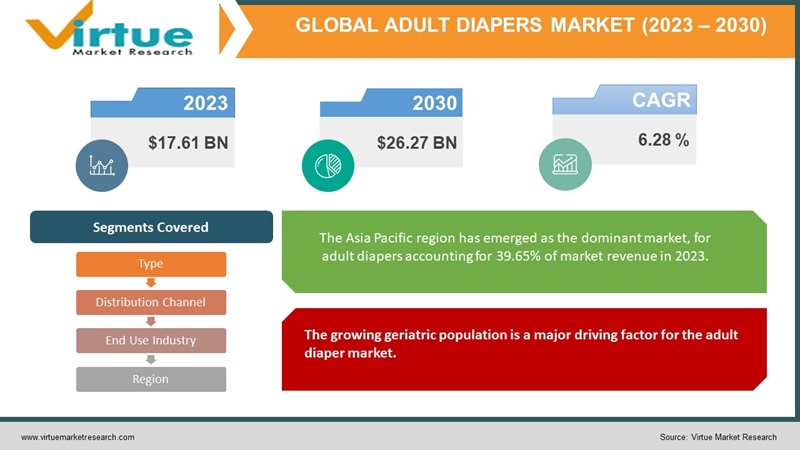

The Global Adult Diapers Market was valued at USD 17.61 billion in 2023 and is projected to reach a market size of USD 26.97 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.28%.

ADULT DIAPERS MARKET (2023 - 2030)

Adult diapers are specially designed absorbent undergarments, for adults who experience difficulties in controlling their bladder or bowel movements. They are worn by individuals who may have challenges in managing these functions. The demand for adult diapers is on the rise due to factors such as an aging population, increased prevalence of diseases, and a growing focus on care. These diapers provide individuals, with comfort, convenience, and protection ultimately enhancing their quality of life and allowing them to maintain their independence. Manufacturers cater to a range of needs and preferences by offering adult diapers in sizes, styles, and levels of absorbency. Furthermore, the progress, in technology has resulted in the creation of adult diaper products that are more discreet, breathable, and gentle on the skin. This aspect has played a role, in driving the growth of the adult diaper market.

Key Market Insights:

According to Eurostats data for 2021, around 20.8% of the European Union population consisted of individuals aged 65 and above. Elderly individuals who suffer from conditions leading to fecal incontinence often rely on diapers or similar products as they struggle to maintain control over their bladder or bowel movements.

Obstacles, like a lack of knowledge and negative perceptions about incontinence in developed nations, are hindering the growth of the market. However, governments are working with adult diaper companies to address these stigmas. This collaborative effort is expected to create growth opportunities, for the market in regions.

Based on data, from the World Bank, it is anticipated that Japan will experience an increase in the need for adult diapers. This is primarily because over 30% of the population in the country will be aged 65 and above by 2021. Many new companies entering the market are concentrating their efforts on expanding their business in emerging economies with a focus, on the Asia Pacific region.

According to a survey conducted by the National Institute of Health it has been found that, more than 48% of individuals in India experience incontinence. Among them 21.8% are women. Additionally, the rise of platforms and the increased accessibility of hygiene products through media and online pharmacies are expected to contribute to a growth in sales. As a result, it is anticipated that the adult diapers market, in India will witness a compound growth rate (CAGR) of 7% during the specified assessment period.

Adult Diapers Market Drivers:

The growing geriatric population is a major driving factor for the adult diaper market.

The increasing number of individuals, in the population is a factor driving the market for adult diapers. In developed nations, there is a proportion of people leading to a global shift in demographics towards an aging population. As individuals grow older their likelihood of experiencing incontinence also increases, which drives up the demand for adult diapers. According to projections by the United Nations it is estimated that by 2030 there will be 1.4 billion people aged 60 and above resulting in a market, for adult diapers.

Growing Incontinence Incidence is fueling the demand for adult diapers.

Incontinence is a condition that affects several individuals worldwide. It can be triggered by factors, like pregnancy birth, surgical procedures, aging processes, and neurological disorders. The need for adult diapers has risen in tandem with the increasing prevalence of incontinence. According to the Centers for Disease Control and Prevention (CDC) over half of the population, in America experiences this condition.

Adult Diapers Market Restraints and Challenges:

The popularity of adult diapers has grown in years resulting in a rise, in the amount of waste produced by these disposable products. This increase in waste is concerning due, to the improper disposal practices associated with using adult diapers. The accumulation of quantities of diaper waste not only contributes to environmental pollution but also poses health risks as it exposes individuals to potentially harmful chemicals used in the manufacturing process. The presence of microorganisms, from waste also rises. As a result the fact that adult diapers are not biodegradable and contain chemicals can cause environmental and health issues, which in turn hinder the growth of the market.

Adult Diapers Market Opportunities:

The rising occurrence of incontinence has resulted in a demand, for adult diapers on the market. With numerous companies competing the market has become saturated prompting manufacturers to create more products to boost sales. Thanks to advancements, absorbent materials with biodegradable components have been developed, benefiting both users and the environment. These advancements have also led to the production of diapers that can last for periods and incorporate moisture lock technology to prevent skin issues. Examples of innovations in the adult diaper market include introducing leak protection or eliminating odors. Ultimately these technological improvements, in quality and comfort will drive the growth of the market.

ADULT DIAPERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.28 % |

|

Segments Covered |

By Type, End User, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nobel Hygiene Pvt. Ltd., , Principle Business Enterprises,, Inc., Rearz Inc., , Attends Healthcare Products Inc., Linette, , Drylock Technologies NV, Tykables, Abena A/S,The Procter & Gamble Company, Kimberly-Clark Corporation |

Adult Diapers Market Segmentation:

Adult Diapers Market Segmentation: By Type

-

Pad Type

-

Tape Type

-

Others

-

Pant Type

The adult diapers market, in 2023 was primarily dominated by the pant type segment, which accounted for one-third of the market share. However, it is anticipated that the tape-type segment will experience a compound growth rate (CAGR) of 8.6% from 2024 to 2030. Moreover among the types of adult diapers in the global market pants style adult diapers are sold at a higher value. One of the factors contributing to the growth in sales value, for this segment is its easy accessibility and reasonable pricing. Both disposable and reusable versions of adult diapers, in this style can be found. The companies have been planning to enhance their product offerings by improving the features and specifications of these pant-style adult diapers anticipating a rise, in demand. They place importance on utilizing high-quality fabric materials and incorporating technology. It is expected that these companies will experience growth in the adult diapers market during the forecast period.

Adult Diapers Market Segmentation: By End-User

-

Women

-

Men

-

Unisex

In 2023 the majority of the market was dominated by women accounting for two-thirds of the market share. However, there is an expectation that unisex products will experience a compound growth rate (CAGR) of 8.7% from 2024 to 2030. Moreover, the market for adult diapers has been steadily expanding due to an increase in females experiencing urine incontinence. Several factors contribute to this rising demand for adult diapers, including pregnancy, aging, stress, and urgency incontinence. Companies like Essity, Unicharm, and Kimberly Clark are developing solutions for incontinence as they see a growing interest among women in portable and reusable pant-style adult diapers. As a result of awareness regarding hygiene and cleanliness benefits, there is exponential growth in the demand for adult diapers, in the market.

Adult Diapers Market Segmentation: By Distribution Channel

-

E-Commerce

-

Offline channel

-

Hypermarket/Supermarket

-

Drug Stores and Pharmacies

-

Others

-

The offline channel was the market force, in 2023 capturing the majority of the market share. However, it is projected that e-commerce will experience a compound growth rate (CAGR) of 8.3% from 2024 to 2030. Moreover, the brick and mortar stores offer an array of product choices spanning industries making it convenient for customers to find what they need. These stores are well organized. Carry a range of adult diapers catering to both local and international customers. Such establishments provide access, to products that cater to market needs. Consequently, the expansion of channels in different regions creates lucrative opportunities for the growth of the adult diaper market. Manufacturers leverage these channels to promote their offerings and collaborate with hypermarkets and supermarkets to increase product visibility resulting in a surge in demand, for adult diapers.

Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific region has emerged as the dominant market, for adult diapers accounting for 39.65% of market revenue in 2023. One of the reasons behind Asia Pacific's dominance in this industry is its population. Countries like China, India, and Japan have several people aged 60 and above. The aging population has been increasing in China and Japan due to birth and death rates influenced by policies over the years. This growing elderly population is expected to drive the demand for adult diapers as it coincides with an increase in cases of incontinence, among individuals. Additionally, it is also anticipated to grow at the fastest rate during the forecast period, 2024-2030.

COVID-19 Impact Analysis on the Global Adult Diapers Market:

The COVID-19 pandemic has made people more conscious, about using hygiene products, such as adult diapers as a measure. This increase in awareness is due to the fear of COVID-19 and emergency regulations aimed at limiting the spread of diseases especially when hospitals are not easily accessible. Additionally, there is a growing demand, for health and wellness products, which further contributes to the market growth. Moreover, COVID-19 has created opportunities for private companies to meet the surging demand.

Latest Trends/ Developments:

The growing number of individuals facing challenges such, as urine incontinence, diarrhea, and dementia is expected to drive the expansion of the adult diaper market. As people age they are more likely to require healthcare. May experience issues with mobility and incontinence. This increased demand for adult diapers is seen worldwide among aging populations who require care. Europe with a proportion of its population aged 65 and over has emerged as a consumer market for adult diapers. According to Eurostats 2021 data than one fifth (20.8%) of the European Union (EU) population falls into this age category. Elderly individuals with conditions leading to fecal incontinence often rely on diapers or similar products due, to their inability to control their bladder or bowels. Some grown-ups who wear diapers spend an amount of time in bed using diapers as a part of their daily routine. On the hand, some individuals may only require diapers, on occasions when they attend events, travel, or find themselves in situations where access to a restroom is limited. The demand for adult diapers caters to a range of experiences and requirements for both males and females resulting in a variety of options available, in the market.

Key Players:

-

Nobel Hygiene Pvt. Ltd.,

-

Principle Business Enterprises,

-

Inc., Rearz Inc.,

-

Attends Healthcare Products Inc.,

-

Linette,

-

Drylock Technologies NV,

-

Tykables, Abena A/S,

-

The Procter & Gamble Company,

-

Kimberly-Clark Corporation

To better meet the needs of its customers and increase production capacity Kimberly Clark Corporation inaugurated a brand manufacturing facility, in Lagos, Nigeria in February 2022.

In October 2020 Kimberly Clark Corporation made a move by acquiring Softex Indonesia, a company, in the personal care products industry of Indonesia. This acquisition aims to broaden and enhance Kimberly Clark's range of offerings.

In October 2020 Kimberly Clark Corporation took a step forward by purchasing Softex Indonesia, a player, in Indonesia's personal care products industry. This acquisition is aimed at expanding and improving the range of offerings, from Kimberly Clark.

Chapter 1. Global Adult Diapers Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Adult Diapers Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Global Adult Diapers Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Adult Diapers Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Adult Diapers Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Adult Diapers Market – By Type

6.1. Pad Type

6.2. Tape Type

6.3. Others

6.4. Pant Type

Chapter 7. Global Adult Diapers Market – By End User

7.1. Women

7.2. Men

7.3. Unisex

Chapter 8. Global Adult Diapers Market – By Distribution Channel

8.1. E-Commerce

8.2. Offline channel

8.3. Hypermarket/Supermarket

8.4. Drug Stores and Pharmacies

8.5. Others

Chapter 9. Global Adult Diapers Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Type

9.1.3. By End User

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Type

9.2.3. By End User

9.2.4. By Distribution Channel

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Type

9.3.3. By End User

9.3.4. By Distribution Channel

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By Type

9.4.3. By End User

9.4.4. By Distribution Channel

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Type

9.5.3. By End User

9.5.4. By Distribution Channel

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Adult Diapers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Nobel Hygiene Pvt. Ltd.,

10.2. Principle Business Enterprises,

10.3. Inc., Rearz Inc.,

10.4. Attends Healthcare Products Inc.,

10.5. Linette,

10.6. Drylock Technologies NV,

10.7. Tykables, Abena A/S,

10.8. The Procter & Gamble Company,

10.9. Kimberly-Clark Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Adult Diapers Market was valued at USD 17.61 billion in 2023 and is projected to reach a market size of USD 26.97 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.28%.

Growing Population Aging and Growing Incontinence Incidence are the Global Adult Diapers Market drivers

Based on End Users, the Global Adult Diapers Market is segmented by End-User women, Men, and Unisex.

Asia Pacific is the most dominant region for the Global Adult Diapers Market.

Nobel Hygiene Pvt. Ltd., Principle Business Enterprises, Inc., Rearz Inc., Attends Healthcare Products Inc., and Linette are the key players operating in the Global Adult Diapers Market.