Water-Based Acrylic Coating Market Size (2024 – 2030)

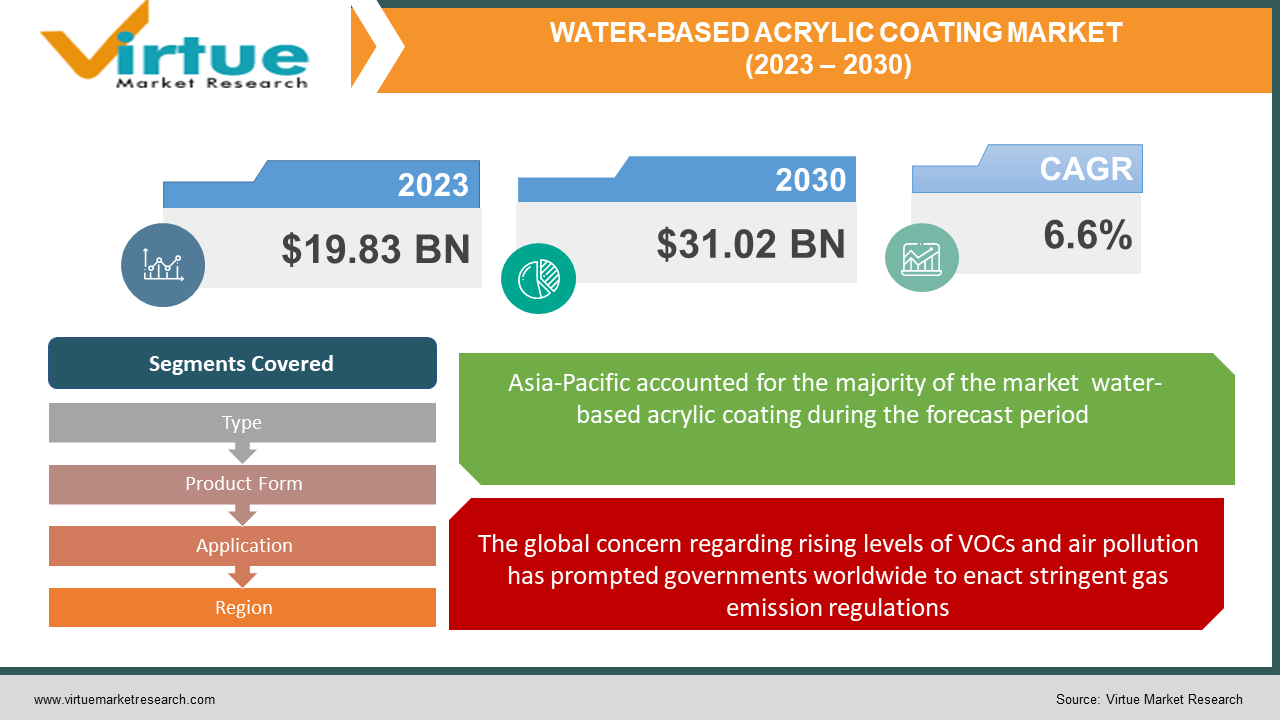

The Global Water-based Acrylic Market was valued at USD 19.83 Billion and is projected to reach a market size of USD 31.02 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.6%.

Water-based acrylic coatings, characterized by their application to diverse material surfaces and utilization of water as the primary solvent, are non-toxic coatings. These coatings employ water-soluble polymers in their development and application, with commonly used water-soluble resins including alkyds, acrylics, styrene-butadiene copolymers, and others. The preference for waterborne coatings over solvent-borne alternatives stems from the reduced release of Volatile Organic Compounds (VOCs) when water-based resins are employed, aligning with environmental considerations.

Distinguishing features of water-based acrylic coatings include their resistance to heat and abrasion, superior adherence, minimal flammability, and the ability to cover larger surface areas with lower solution quantities. Aqueous acrylic coatings find widespread use in various sectors such as automotive, building, woodworking, construction, and packaging. The comprehensive evaluation of waterborne acrylic coatings' market consumption is a key aspect of market studies in this domain. The promotion of water-based acrylic coatings, driven by governmental initiatives favoring their superior performance compared to conventional coatings, contributes to the expansion of the business in this sector.

MARKET DRIVERS

The growth of the Water-based Acrylic Coating Market is propelled by the increasing demand for waterborne acrylic coatings in end-user industries, including automotive, construction, and infrastructure.

A notable trend in the coatings industry involves a rising preference for environmentally friendly attributes, influenced significantly by stringent EU regulations targeting the reduction of volatile organic compound (VOC) emissions from coatings. The European Commission and other government bodies introduce measures such as the Eco-product Certification Scheme (ECS) to ensure environmentally sound practices with minimal toxic VOC emissions.

The coatings industry has experienced a shift from solvent-borne coatings to environmentally friendly alternatives like waterborne coatings. This shift is driven by regulations in the US and Western Europe addressing air pollution concerns and increasing awareness of the adverse effects of VOC emissions. Governmental initiatives, particularly those regulating VOC emissions and addressing air pollution, serve as pivotal drivers for the market.

The global concern regarding rising levels of VOCs and air pollution has prompted governments worldwide to enact stringent gas emission regulations.

In response, industries are actively seeking ways to minimize VOC emissions associated with acrylic coating production processes, fostering increased demand for water-based acrylic coatings. These factors collectively contribute to the anticipated growth of the market in the forecasted years.

MARKET RESTRAINTS

The impediment to market growth lies in the extended drying time required.

Water-based acrylic coatings exhibit prolonged drying periods compared to their solvent-borne counterparts. The unique flow characteristics of waterborne coatings are contingent upon humidity levels, influencing the application process. In environments with elevated humidity, water evaporation is sluggish, leading to suboptimal curing and reduced efficacy. Furthermore, susceptibility to cold temperatures renders the coating unusable after freezing.

COVID-19 Impact on the Global Water-based Acrylic Coatings Market:

The ongoing global COVID-19 pandemic has inflicted a detrimental impact on various industries, as precautionary measures to curb virus transmission have been paramount. The pervasive fear instilled by the virus, coupled with the associated uncertainties, has disrupted normalcy worldwide. Government-imposed lockdowns brought about a cessation of operations in businesses and offices, ushering in a period of standstill in daily life. To sustain operational continuity during these challenging times, governments implemented rules and restrictions that the workforce had to adhere to diligently.

The prevailing threat compelled several industries, including construction, automotive, white goods, and electronics, to decelerate, resulting in diminished demand for paints and coatings in the market. Adherence to stringent laws and regulations imposed by governments became imperative for industries navigating through these unprecedented circumstances.

Latest Industry Developments:

In September 2020, Dow (NYSE: DOW) unveiled its innovative adhesive portfolio, INVISUTM Acrylic Adhesives, in the North American region. This strategic introduction represents a pivotal advancement for pressure-sensitive paper, offering producers and brand owners enhanced capabilities to meet the evolving demands of the industry efficiently.

WATER-BASED ACRYLIC COATING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.6% |

|

Segments Covered |

By Type of Acrylic Resin, Product Form, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cardolite Corporation (U.S.), BASF SE (Germany), Cardolite Corporation (U.S.), Kukdo Chemical Co., Ltd., (South Korea), Evonik Industries AG (Germany), Aditya Birla Group Chemicals (India), Mitsubishi Chemical Corporation (Japan), Arkema (France), Hexion (U.S.), Huntsman International LLC (U.S.) |

Water-based Acrylic Coating Market Segmentation - By Type of Acrylic Resin

-

Pure Acrylic

-

Styrene Acrylic

-

Vinyl Acrylic

-

Ethylene Acrylic

-

Methyl Methacrylate Acrylic

In 2023, the segment with the highest revenue share was Methyl Methacrylate Acrylic, primarily driven by the rapid growth of the healthcare industry. This resin is extensively utilized in medical applications, such as filling gaps between implants and bone structures, owing to its lightweight and biocompatible nature. The Styrene Acrylic segment is expected to experience the most substantial growth during the forecast period (2024-2030), attributed to its widespread usage in the construction industry for applications like ceramic tile adhesives, elastomeric roof coatings, fillers, putties, and others.

Water-based Acrylic Coating Market Segmentation - By Product Form

-

Emulsions

-

Dispersions

The Emulsions segment is projected to hold the highest market share in 2023 and is forecasted to be the fastest-growing segment. This is due to the broad applications of emulsions in coatings and paintings, appreciated for their user-friendly properties and durability. Emulsions, particularly favored for adhesive paints and coatings, find extensive use across various industry verticals.

Water-based Acrylic Coating Market Segmentation - By Application

-

Architectural Coatings

-

Interior Wall Paints

-

Exterior Wall Paints

-

Trim Paints

-

Roof Coatings

-

-

Industrial Coatings

-

Metal Coatings

-

Plastic Coatings

-

Wood Coatings

-

Masonry Coatings

-

Concrete & Floor Coatings

-

-

Automotive Coatings

-

Wood Finishes

-

Furniture Coatings

-

Paper & Board Coatings

-

Others

-

Architectural coatings dominated the market in 2023, driven by the expanding infrastructure industry. The preference for these coatings in construction projects is due to their water resistance, excellent finish, and uniform drying time. Although architectural coatings held the highest market share, the growing demand for new construction projects in the healthcare and medical sectors is expected to present new growth opportunities. The prominence of individual vehicles for private transportation is gradually fueling market expansion. Moreover, the pandemic has heightened the demand for construction work in the healthcare sector.

Water-based Acrylic Coating Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Asia-Pacific led both in terms of value and volume in the global Water-based Acrylic Coating market in 2023. The region is poised for significant market growth, fueled by substantial infrastructure developments and increasing construction activities, particularly in countries like China, India, and Japan. The fast urbanization resulting from rural-to-urban migration has also contributed significantly to the market's growth in the Asia-Pacific region. North America, due to its relatively developed economies, is expected to witness the highest market growth, further accelerated by recent economic crises in these areas. Similar growth trends have been observed in other economically developing regions, including the Middle East, Africa, and Latin America.

Water-based acrylic Coating market segmentation – By Company

-

Cardolite Corporation (U.S.)

-

BASF SE (Germany)

-

Cardolite Corporation (U.S.)

-

Kukdo Chemical Co., Ltd., (South Korea)

-

Evonik Industries AG (Germany)

-

Aditya Birla Group Chemicals (India)

-

Mitsubishi Chemical Corporation (Japan),

-

Arkema (France)

-

Hexion (U.S.)

-

Huntsman International LLC (U.S.)

Chapter 1. Global Water-based Acrylic Coating Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Water-based Acrylic Coating Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Global Water-based Acrylic Coating Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Water-based Acrylic Coating Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Water-based Acrylic Coating Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Water-based Acrylic Coating Market– By Type of Acrylic Resin

6.1. Introduction/Key Findings

6.2. Pure Acrylic

6.3. Styrene Acrylic

6.4. Vinyl Acrylic

6.5. Ethylene Acrylic

6.6. Methyl Methacrylate Acrylic

6.7. Y-O-Y Growth trend Analysis By Type of Acrylic Resin

6.8. Absolute $ Opportunity Analysis By Type of Acrylic Resin, 2023-2030

Chapter 7. Global Water-based Acrylic Coating Market– By Product Form

7.1. Introduction/Key Findings

7.2. Emulsions

7.3. Dispersions

7.4. Y-O-Y Growth trend Analysis By Product Form

7.5. Absolute $ Opportunity Analysis By Product Form, 2023-2030

Chapter 8. Global Water-based Acrylic Coating Market– By Application

8.1. Introduction/Key Findings

8.2. Architectural Coatings

8.2.1. Interior Wall Paints

8.2.2. Exterior Wall Paints

8.2.3. Trim Paints

8.2.4. Roof Coatings

8.3. Industrial Coatings

8.3.1. Metal Coatings

8.3.2. Plastic Coatings

8.3.3. Wood Coatings

8.3.4. Masonry Coatings

8.3.5. Concrete & Floor Coatings

8.4. Automotive Coatings

8.5. Wood Finishes

8.6. Furniture Coatings

8.7. Paper & Board Coatings

8.8. Others

8.9. Y-O-Y Growth trend Analysis Application

8.10. Absolute $ Opportunity Analysis Application, 2023-2030

Chapter 9. Global Water-based Acrylic Coating Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Type of Acrylic Resin

9.1.3. By Product Form

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Type of Acrylic Resin

9.2.3. By Product Form

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Type of Acrylic Resin

9.3.3. By Product Form

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Type of Acrylic Resin

9.4.3. By Product Form

9.4.4. By Application

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Type of Acrylic Resin

9.5.3. By Product Form

9.5.4. By Application

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Water-based Acrylic Coating Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cardolite Corporation (U.S.)

10.2 BASF SE (Germany)

10.3. Cardolite Corporation (U.S.)

10.4. Kukdo Chemical Co., Ltd., (South Korea)

10.5. Evonik Industries AG (Germany)

10.6. Aditya Birla Group Chemicals (India)

10.7. Mitsubishi Chemical Corporation (Japan),

10.8. Arkema (France)

10.9. Hexion (U.S.)

10.10. Huntsman International LLC (U.S.)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Water-based Acrylic Coating Market was estimated to be worth USD 19.83 Billion in 2023 and is projected to reach a value of USD 31.02 Billion by 2030, growing at a CAGR of 6.6% during the forecast period 2024-2030

Increasing demand for Waterborne Acrylic coatings in end users’ industries like automotive, construction, and infrastructure is driving growth in Water-based acrylic Coating Market.

Based on the product form, the Global Water-based Acrylic Coating market is segmented into Emulsions and Dispersions

Asia-Pacific holds the largest share of the Global Water-based Acrylic Coating market

Aditya Birla Group Chemicals, Mitsubishi Chemical Corporation, Arkema, and Unilever are a few of the leading players in the Global Water-based Acrylic Coating market