Transparent Wood Market Size (2023 – 2030)

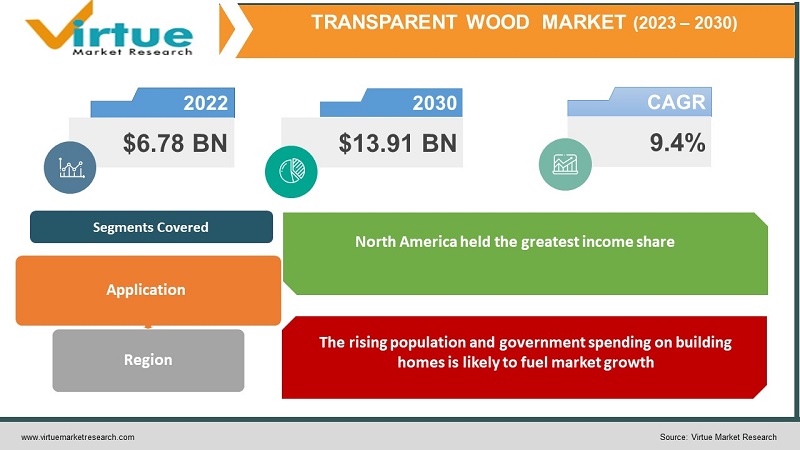

The Transparent Wood Market was valued at USD 6.78 billion in 2022 and is projected to reach USD 13.91 billion by 2030. The market is anticipated to expand at a CAGR of 9.4% over the forecast period.

INDUSTRY OVERVIEW

Wood strips that have been treated and compressed result in transparent wood, a form of building material. A form of wood veneer called optically transparent wood is made by chemically removing the cell wall substance lignin. Compared to its substitutes like plastic and glass, it is an environmentally safe material. Polymers are used in place of lignin to generate translucent wood, which is transparent as a result. Comparatively speaking, transparent wood is much lighter than lumber wood. The strength of each of these materials is comparable, though. In terms of bio-based construction materials, wood is by far the most prevalent. In both residential and commercial construction, transparent wood is employed in a variety of applications. Due to its exceptional collection of qualities, including its higher optical transmittance, lower thermal conductivity, exceptional durability, and lower density than glass, transparent wood is a favorite building material among architects and builders.

The Food and Agriculture Organization of the United Nations (FAO) statistics provided in 2018 reveal that the value of international commerce increased by 11% compared to 2017. This suggests that the worldwide demand for wood does not appear to be decreasing. This is the greatest level in 70 years, according to the FAO. Consumption is high, but stronger rules and laws about sustainable development have changed consumer attitudes. The usage of transparent wood for commercial purposes has finally been discovered by researchers.

COVID-19 IMPACT ON THE TRANSPARENT WOOD MARKET

On March 11, 2020, the World Health Organization declared COVID-19 a public health emergency due to its global proliferation to over 213 nations. Germany, France, Italy, Spain, the United Kingdom, and Norway are a few of the main economies that were impacted by the COVID-19 crisis. Due to the COVID-19 epidemic, transportation restrictions were put in place, which decreased industrial output and disrupted supply networks. Consequently, having a significant negative influence on the growth of the global economy and the market. The market is continually experiencing tremendous uncertainty as a result of the COVID-19 epidemic. The countries' declining GDPs and the downturn in the manufacturing industry have further curtailed the activities involved in manufacturing. Due to a lack of labor in the manufacturing industries as well as a decline in demand from the construction industries, consumers' desire for semi-finished goods is falling. The COVID-19 epidemic resulted in an export and import embargo, affecting the supply chain and slowing the expansion of the transparent ceramics industry. The COVID-19 epidemic caused a huge imbalance between supply and demand. Particularly in the first two quarters of 2020, the COVID-19 pandemic hurt several sectors. The market for transparent concrete is also affected negatively. The majority of the nation's governments enacted several strict laws, including lockdowns, travel restrictions, shutting down educational institutions, and many more, to stop the virus's spread. The World Health Organization (WHO) has declared this virus to be pandemic and has issued some safety precautions.

The manufacturing sectors had several problems as a result of the lockdowns, including supply chain disruptions, a labor shortage, and a scarcity of raw materials, which caused the production of transparent concrete to cease. Additionally, these industries are closed for a short period, which lowers consumer demand. In this sense, chemical and material goods have an impact on the epidemic. Additionally, because of the shutdown, there is less translucent wood used during construction. However, with the mass vaccination campaign underway, the situation globally is improving, and it is hoped that the market will soon recover.

MARKET DRIVERS:

The rising population and government spending on building homes is likely to fuel market growth

By 2030, there will be 8.2 billion people on the planet, up from 6.4 billion in 2021. To meet the housing demands of the expanding population, governments in nations including Bahrain, India, the Kingdom of Saudi Arabia, and the UAE are planning to construct residences. The demand for residential properties and numerous other building projects is being driven mostly by the growth in the world's population and the amount of disposable money available. In the upcoming years, it is anticipated that this would increase the demand for transparent wood.

High investment in the building and construction industry to fuel market expansion

About US$16 trillion was added to the global GDP between 1970 and 2005. By 2021, it is projected to reach USD 100 trillion. In the last several years, there have been significant investments made globally in the building and construction business. It is projected that the global market for transparent wood would see growth shortly as economic circumstances in emerging nations like Vietnam, Indonesia, Thailand, and India improve, particularly in the building industry. In contrast to 2020, sales of wood-related goods like transparent wood rose by 11% in 2021 (according to a study from the Food and Agriculture Organization of the United Nations, or FAO). Therefore, the rising investment and growth in the GDP are positively impacting the industry growth

Transparent wood can cut input cost, as a result, are widely used which is driving market expansion

The use of artificial lighting in houses and other structures can be decreased by using transparent wood. Glass and steel are being used extensively in urban design. Transparent wood and other biodegradable materials can save heating expenses and hence lessen fuel usage. Therefore, these materials are widely being adopted in the construction industry which is fueling market expansion.

MARKET RESTRAINTS:

Transparent wood can be damaged when in contact with water, which as a result may hamper the market expansion

Transparent wood is more susceptible to water damage. Transparent wood may suffer exterior damage as a result of this. To protect the wood substance, regular wood sealant sealing is necessary. This is one of the elements that might soon have a detrimental effect on the market for transparent wood.

The advent of Covid and the supply chain crisis caused by it has negatively impacted the market growth

The COVID-19 pandemic-related lockdown is causing temporary slowdowns in nations including China, the United States, and Japan. The manufacturing sectors had several problems as a result of the lockdowns, including supply chain disruptions, a labor shortage, and a scarcity of raw materials, which caused the production of transparent wood to cease. Additionally, these industries are closed for a short period, which lowers consumer demand. In this sense, chemical and material goods have an impact on the epidemic. Additionally, because of the shutdown, there is less translucent wood used during construction

TRANSPARENT WOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9.4% |

|

Segments Covered |

By Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GEORGIA-PACIFIC WOOD PRODUCTS LLC, FRITZ EGGER GMBH & CO. OG, BERNECK S.A., TIMBER PRODUCTS CO., ROSEBURG FOREST PRODUCTS CO., WEYERHAEUSER, MEDITE EUROPE LTD, BORG MANUFACTURING, UNIVERSAL WOODS INC., RICHWOOD INDUSTRIES, INC., KRONOSPAN LIMITED, DURATEX SA, SWISS KRONO GROUP, DAIKEN CORPORATION, DARE WOOD-BASED PANELS GROUP CO., LTD. |

This research report on the Transparent Wood Market has been segmented and sub-segmented based on Application and By Region.

TRANSPARENT WOOD MARKET – BY APPLICATIONS

-

Construction

-

Furniture

-

Solar Cell

-

Other

Based on the application the transparent wood market is segmented into, Construction, Furniture, Solar Cell and Others. Among these, transparent wood is primarily used in the construction and building industry. Along with its major usage in furniture and building, transparent wood also has several other uses. The capacity to absorb energy has created new business opportunities. Due to its strength and lightweight, it may take the place of stone and steel in buildings. In addition to being waterproof and fire resistant, they may also be utilized as pillars.

Additionally, researchers assert that transparent wood might take the role of glass in solar panels, revolutionizing the already burgeoning solar power sector. By using transparent wood, it will be possible to create good thermal insulation while allowing enough light to flow through directed solar transmission. Applications for transparent wood can go further into augmented reality, where the incorporation of electronics can create touch-sensitive wooden dashboards.

TRANSPARENT WOOD MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

By region, the Transparent Wood Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. The largest market for transparent wood is anticipated to be in North America, followed by Europe. Growing building activity, a plentiful supply of wood, wood's aesthetic appeal, and its environmental sustainability all contribute to increased demand for wood in the United States and Canada. Transparent wood will inevitably become a popular option due to renovation and rework operations, particularly in the residential market. Since Europe is at the forefront of innovation, it is anticipated that they will be the first to use transparent wood. In terms of the transparent timber market, sustainability and the desire for renewable energy are crucial. Additionally, it is anticipated that the potential of transparent wood in the automotive industry would ignite demand. Europe is gradually phasing out traditional lumber in favor of non-tropical timber alternatives. Transparent wood can be beneficial as an alternative to plastic for consumers who are becoming more environmentally conscious.

Japan is a developed country with traditional customs that place a greater emphasis on a desire for wood, and it is anticipated that it will be one of the top customers on the market. Japanese architecture makes extensive use of wood. A sizable portion of the population continues to build with imported laminated lumber and wood. The transparent wood offers the energy and financial efficiency that Japanese people strongly value. Transparent wood is being developed by Chinese scientists in newer, more environmentally friendly ways. China's overall wood consumption has increased significantly during the last ten years. The China Association of Forest Products Industry estimates that during the last 10 years, China's overall wood consumption has climbed by 173%. It is anticipated that China would concentrate on creating transparent wood greenhouses after it has confirmed that the product is saleable.

India's wood sector is now going through a period of upheaval. The sector is becoming more structured, and businesses like IKEA are attempting to establish strongholds in the area. The fact that India is a net importer of wood panels makes an argument for transparent wood. Indian demand for transparent wood would have an influence on the market due to the country's expanding population of about 1.3 billion people, rising disposable income, and customer preference for wood-based goods.

TRANSPARENT WOOD MARKET - BY COMPANIES

Some of the major players operating in the Transparent Wood Market include:

-

GEORGIA-PACIFIC WOOD PRODUCTS LLC

-

FRITZ EGGER GMBH & CO. OG

-

BERNECK S.A.

-

TIMBER PRODUCTS CO.

-

ROSEBURG FOREST PRODUCTS CO.

-

WEYERHAEUSER

-

MEDITE EUROPE LTD

-

BORG MANUFACTURING

-

UNIVERSAL WOODS INC.

-

RICHWOOD INDUSTRIES, INC.

-

KRONOSPAN LIMITED

-

DURATEX SA

-

SWISS KRONO GROUP

-

DAIKEN CORPORATION

-

DARE WOOD-BASED PANELS GROUP CO., LTD.

Chapter 1. Transparent Wood Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Transparent Wood Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Transparent Wood Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Transparent Wood Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Transparent Wood Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Transparent Wood Market – By Application

6.1. Construction

6.2. Furniture

6.3. Solar Cell

6.4. Other

Chapter 7. Transparent Wood Market- By Region

7.1. North America

7.2. Europe

7.3. Asia-Pacific

7.4. Latin America

7.5. The Middle East

7.6. Africa

Chapter8. Transparent Wood Market – key players

8.1 GEORGIA-PACIFIC WOOD PRODUCTS LLC

8.2 FRITZ EGGER GMBH & CO. OG

8.3 BERNECK S.A.

8.4 TIMBER PRODUCTS CO.

8.5 ROSEBURG FOREST PRODUCTS CO.

8.6 WEYERHAEUSER

8.7 MEDITE EUROPE LTD

8.8 BORG MANUFACTURING

8.9 UNIVERSAL WOODS INC.

8.10 RICHWOOD INDUSTRIES, INC.

8.11 KRONOSPAN LIMITED

8.12 DURATEX SA

8.13 SWISS KRONO GROUP

8.14 DAIKEN CORPORATION

8.15 DARE WOOD-BASED PANELS GROUP CO., LTD.

Download Sample

Choose License Type

2500

4250

5250

6900