Radar Sensors Market Size (2024 – 2030)

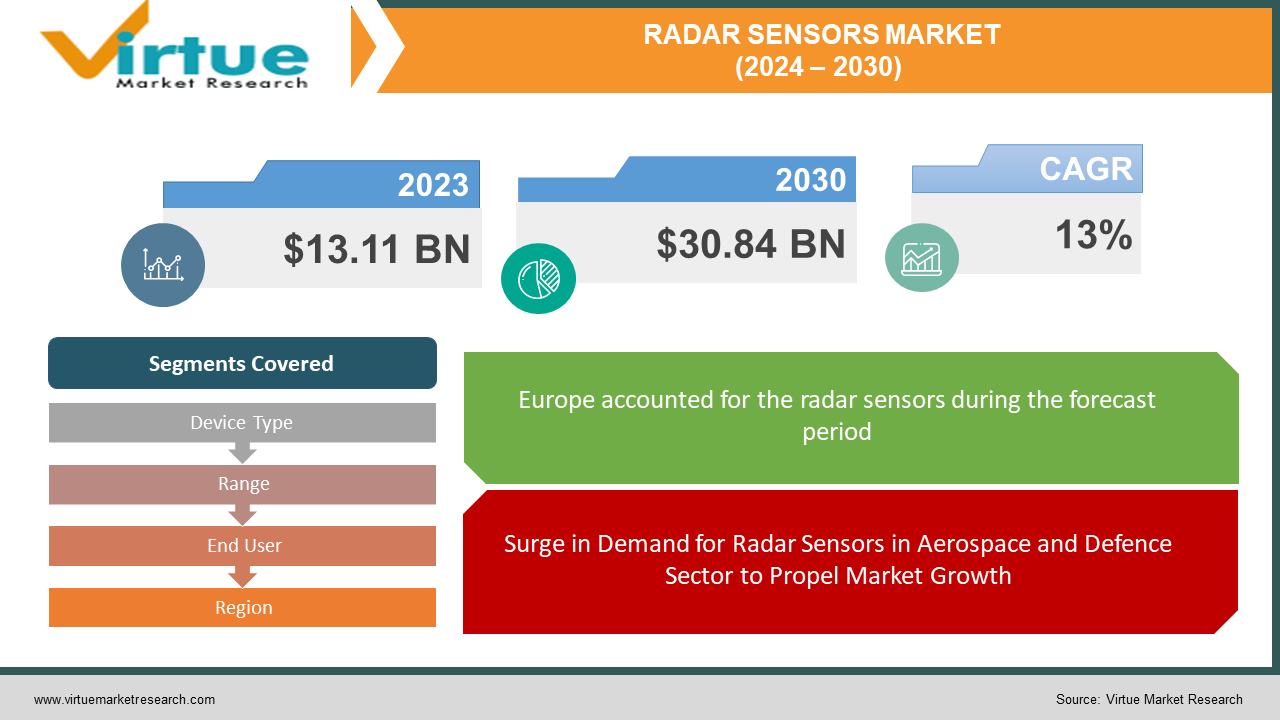

The Global Radar Sensors Market size was exhibited at USD 13.11 billion in 2023 and is projected to hit around USD 30.84 billion by 2030, growing at a CAGR of 13% during the forecast period from 2024 to 2030.

A radar sensor, an advanced technological apparatus utilized for the detection and localization of objects through the emission and analysis of radio waves and their reflections, holds significance in various domains, including aviation, automotive systems, weather monitoring, and military operations. The acronym "Radar" stands for "Radio Detection and Ranging."

In the automotive sector, radar sensors serve as integral components within Advanced Driver Assistance Systems (ADAS), facilitating functionalities such as collision avoidance and adaptive cruise control. In aviation, these sensors contribute to air traffic control, ensuring the secure navigation of aircraft. Meanwhile, in military contexts, radar sensors find application in surveillance, target tracking, and missile guidance. The adaptability and precision of radar sensors establish them as indispensable tools across diverse industries, enhancing safety, efficiency, and situational awareness in various operational scenarios.

Key Market Insights:

The Radar Sensor market experiences impetus propelled by factors like the escalating demand for surveillance and increasing global security concerns. Radar sensors find applications in surveillance across diverse sectors, including airports, solar farms, oil and gas production facilities, power plants, and railways. The defense and law enforcement sectors witness a rising need for surveillance due to growing security threats and terrorism. The radar sensor market benefits from the heightened demand for border monitoring and access to sensitive areas. Governments globally invest significantly in infrastructure improvement, presenting growth opportunities for the radar sensor market. The substantial demand for radar sensors in government sectors, including federal agencies and local, and state governments, for purposes like border monitoring, infrastructure security, and homeland security contributes significantly to market growth.

Government investments worldwide, driven by increasing disputes, regional unrest, and terrorism concerns, emerge as a major positive factor influencing the radar sensor market's growth. The automotive sector significantly propels the radar sensor industry, with increased demand for applications such as obstacle detection, autonomous emergency braking systems, predictive crash sensing, and speed sensing. Radar sensors, employed in driver assistance systems, respond to the rising instances of road accidents, offering numerous growth opportunities in the Radar Sensor market. The integration of radar sensors in automotive applications like parking assistance systems, collision warnings, and adaptive cruise control further augments their prevalence and utility.

Global Radar Sensors Market Drivers:

Surge in Demand for Radar Sensors in Aerospace and Defence Sector to Propel Market Growth

Radar sensors, within the aerospace domain, play a pivotal role in ensuring safety and security standards by detecting the position and velocity of objects, including aircraft, from a distance. These sensors contribute to enhanced safety and efficiency in both commercial and military aviation through precise distance measurement. Moreover, they are integral components of airborne surveillance systems, utilized in spy planes to detect unexpected arrivals of enemy forces and monitor suspicious activities. In aviation systems, radar sensors furnish detailed information about missile types, trajectories, and targets, facilitating early detection of potential missile attacks. The ongoing advancements in aerospace and defense equipment, particularly in environmental sensing and obstacle detection instruments, are driving the growth of the radar sensor market.

Increasing Imperative for Safety and Security in Automotive Applications Boosts Market Expansion

Radar sensors are crucial for sensing the environment and supplying data to adaptive cruise control and collision avoidance systems within the automotive sector. In this domain, their primary functions involve detecting blind spots, providing advanced driving assistance, and issuing lane departure warnings. These sensors are instrumental in safety control systems, aiding in clearer differentiation between objects on the roads. The growing number of government regulations aimed at enhancing vehicle safety, coupled with the rising adoption of Advanced Driver-Assistance Systems (ADAS) technology, is accelerating the demand for radar sensors in the automotive industry.

Furthermore, key industry players are investing significantly in research and development to introduce advanced sensors operating on new frequency bands. For instance, in June 2016, HELLA GmbH & Co. KGaA, a prominent sensor technology supplier, launched a 77GHz radar sensor featuring NXP’s RF CMOS radar chip, opening up new application possibilities for automotive radar. This increased adoption of radar sensors in the automotive sector is propelling the overall growth of the radar sensor market.

Global Radar Sensors Market Restraints and Challenges:

Growing Adoption of LiDAR Sensors Poses Constraints on Market Growth

The rapid adoption of LiDAR sensors in the market, offering precise 3D monochromatic imaging and enhanced detection of smaller objects due to shorter wavelengths, is limiting the growth of radar sensors. Operating on longer wavelengths, radar sensors struggle to provide the same level of accuracy and speed in measuring distances between objects, thus impeding their market growth.

Environmental Interference and Privacy Concerns Impede Market Progress

The market faces notable obstacles due to environmental interference and privacy concerns associated with radar sensors. Adverse weather conditions, such as heavy rain, snow, or fog, can disrupt radar signals, restricting their effectiveness across various applications. Industries relying on radar technology, including autonomous vehicles and surveillance systems, encounter challenges in maintaining consistent performance under diverse weather conditions. Additionally, privacy concerns pose a significant restraint on market demand, especially in applications like smart cities and surveillance. Striking a balance between the advantages of radar sensor technology and addressing privacy apprehensions is crucial for overcoming these constraints and fostering market acceptance. As the industry endeavors to develop solutions addressing both environmental challenges and privacy considerations, the demand for radar sensors is expected to overcome these hurdles and advance.

Global Radar Sensors Market Opportunities:

Exploiting Opportunities through Drone Technology and 5G Integration

The conjunction of drone technology and 5G integration presents substantial opportunities for the radar sensor market. In the domain of drone technology, radar sensors assume a crucial role in applications like collision avoidance, navigation, and surveillance. As drones gain prominence across industries such as agriculture, infrastructure inspection, and security, the demand for radar sensors experiences a notable upswing. These sensors furnish essential data for ensuring the safety and efficiency of drone operations, thereby creating pathways for innovation and growth within the drone industry.

The incorporation of 5G networks represents a transformative avenue for radar sensors by augmenting connectivity and communication capabilities. Leveraging the increased bandwidth and low-latency features of 5G, radar sensors can transmit and receive data with enhanced efficiency, facilitating real-time decision-making across diverse applications. This integration proves advantageous for sectors like autonomous vehicles, smart cities, and industrial automation, where radar sensors heavily rely on seamless and swift data exchange.

The synergistic relationship between radar sensors, drone technology, and 5G integration paints a promising trajectory for the future of radar sensor applications. This synergy not only fosters advancements but also broadens the scope of radar sensors in diverse industries, emphasizing their pivotal role in shaping technological landscapes.

RADAR SENSORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13% |

|

Segments Covered |

By Device Type, Range, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Texas Instruments, Infineon Technologies, NXP Semiconductors, Analog Devices, STMicroelectronics, Bosch Sensortec, Qualcomm Technologies, Honeywell International Inc., Continental AG |

Global Radar Sensors Market Segmentation: By Device Type

-

Imaging

-

Non imaging

In 2023, the imaging category dominated with the highest market share of 61%. Within the radar sensor market, imaging involves utilizing radar technology to create visual representations of the surrounding environment. Advanced signal processing in imaging radar sensors produces detailed maps, enhancing capabilities in object recognition and tracking. A notable trend in the imaging radar segment is the escalating demand for high-resolution and synthetic aperture radar (SAR) technologies. These trends cater to applications such as autonomous vehicles and surveillance systems, where precise imaging and mapping are crucial for reliable decision-making and situational awareness.

The non-imaging segment is projected to experience significant growth at a notable CAGR of 15.2% during the forecast period. In the radar sensor market, the non-imaging sector encompasses sensors focusing on detecting and analyzing the presence, speed, and direction of objects without generating visual images. This segment includes continuous wave radar and pulse radar technologies, finding increased adoption in applications like industrial automation, traffic management, and drone navigation. Non-imaging radar sensors offer cost-effective solutions for precise object detection, proving pivotal in scenarios where image visualization is not a primary requirement.

Global Radar Sensors Market Segmentation: By Range

-

Short range

-

Medium range

-

Long range

According to the range, the medium-range segment secured 43% of the market share in 2023. This segment typically refers to sensors with a detection range spanning from a few hundred meters to several kilometers. Medium-range radar sensors find extensive applications in automotive systems, traffic management, and industrial settings.

A key trend in this segment involves ongoing advancements aimed at enhancing the accuracy and resolution of medium-range radar sensors, improving their performance in applications like adaptive cruise control and collision avoidance systems. The growing demand for reliable and cost-effective medium-range radar solutions is driven by the increasing integration of radar sensors in various safety and surveillance applications.

The short-range segment is expected to witness the highest growth during the projected period. In the radar sensor market, the short-range category typically refers to sensors with a detection distance of up to a few hundred meters. Short-range radar sensors find extensive applications in urban environments, parking assistance systems, and collision avoidance scenarios. Advancements in miniaturization and cost-effectiveness are notable trends in this segment, making short-range radar sensors more accessible for integration into vehicles, smart city infrastructure, and consumer electronics. This trend fosters the development of innovative applications, enhancing safety features and driving the overall growth of the short-range radar sensor market.

Global Radar Sensors Market Segmentation: By End User

-

Automotive

-

Aerospace and Defense

-

Environment and Weather Monitoring

-

Industrial

-

Others

According to end-user segmentation, the automotive segment accounted for 31% of the market share in 2023. In the radar sensor market's automotive segment, these sensors are integral components of Advanced Driver Assistance Systems (ADAS). They facilitate collision detection, adaptive cruise control, and parking assistance, contributing to enhanced vehicle safety. A notable trend is the increasing integration of radar sensors in autonomous vehicles, aligning with the industry's progression toward self-driving technologies. As automakers prioritize safety features and autonomous capabilities, the demand for radar sensors in the automotive sector is expected to experience sustained growth.

The environment and weather monitoring segment is projected to witness the highest growth during the forecast period. In the radar sensor market, this segment focuses on using radar technology to gather real-time data for environmental conditions, including applications in weather forecasting, flood detection, and wildfire tracking. The increasing demand for radar sensors in environmental monitoring, driven by their ability to operate in challenging weather conditions, indicates a growing trend. This segment is witnessing growth as governments, research institutions, and industries seek accurate and timely information for climate-related decisions, emphasizing the importance of radar sensors in enhancing weather monitoring capabilities.

Global Radar Sensors Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe dominated with the largest revenue share of 41% in 2023. The region's prominence in the radar sensor market is attributed to robust advancements in automotive safety regulations and the widespread adoption of radar sensors in the automotive industry. Europe's commitment to promoting intelligent transportation systems and smart city initiatives has further fueled the demand for radar sensors. Additionally, Europe's focus on research and development, coupled with stringent safety standards, has propelled the integration of radar sensor technologies across various sectors, contributing to the region's significant market share in this dynamic and evolving industry.

Asia-Pacific is anticipated to witness the highest growth, dominating the radar sensor market due to rapid industrialization, urbanization, and the surge in automotive production. The region's extensive deployment of radar sensors in vehicles for advanced driver assistance systems (ADAS) and the increasing adoption of smart technologies in sectors like infrastructure and agriculture contribute to its major market share. Moreover, government initiatives promoting smart city development and the robust expansion of the electronics industry in countries like China and Japan further propel the growth of radar sensor applications, solidifying Asia-Pacific's significant position in the market.

COVID-19 Impact Analysis on the Global Radar Sensors Market:

The global concern and economic challenges resulting from the COVID-19 outbreak have had a profound impact on consumers, businesses, and communities worldwide. The semiconductor sector, a vital component of various industries, faced disruptions in the supply chain of raw materials and witnessed disturbances across the electronics value chain. This situation prompted a heightened emphasis on assessing and mitigating risks throughout the end-to-end value chain. Major manufacturing entities prioritized public health, implementing substantial changes to the working lifestyle of their employees. The swift adoption of a remote working culture was encouraged, with the industry taking robust measures to ensure the safety of the workforce in alignment with government advisories. These adjustments are anticipated to exert a significant influence on the radar sensors market.

Recent Trends and Developments in the Global Radar Sensors Market:

December 2022: Continental, a prominent technology company, has extended exclusive support to the Indy Autonomous Challenge (IAC). This collaborative initiative, involving public-private partnerships and academic institutions, aims to design, build, and demonstrate a new generation of automated vehicle software for fully autonomous racecars. Continental will provide the IAC with access to its ARS540 4D imaging radar sensors, which will be utilized in the Dallara AV-21, recognized as the world's fastest autonomous racecar and capable of highly automated driving.

February 2022: NXP Semiconductor announced a significant development involving its partner, Innovative Micro, which introduced a 4D imaging radar sensor featuring NXP's 6th generation flagship radar processor S32R45. This radar sensor integrates four TEF8232 transceivers, resulting in 192 virtual channels and delivering an angular resolution of one degree at distances up to 300 meters.

January 2022: DENSO, a leading mobility supplier, unveiled the Global Safety Package, an active safety system designed to enhance vehicle safety by providing high sensing capability of the surroundings. This safety package combines the performance of a vision sensor and a millimeter-wave radar sensor, assisting drivers in safely controlling the vehicle.

Key Players:

-

Texas Instruments

-

Infineon Technologies

-

NXP Semiconductors

-

Analog Devices

-

STMicroelectronics

-

Bosch Sensortec

-

Qualcomm Technologies

-

Honeywell International Inc.

-

Continental AG

Chapter 1. Radar Sensors Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Radar Sensors Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Radar Sensors Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Radar Sensors Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Radar Sensors Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Radar Sensors Market – By Device Type

6.1 Introduction/Key Findings

6.2 Imaging

6.3 Non imaging

6.4 Y-O-Y Growth trend Analysis By Device Type

6.5 Absolute $ Opportunity Analysis By Device Type , 2024-2030

Chapter 7. Radar Sensors Market – By Range

7.1 Introduction/Key Findings

7.2 Short range

7.3 Medium range

7.4 Long range

7.5 Y-O-Y Growth trend Analysis By Range :

7.6 Absolute $ Opportunity Analysis By Range :, 2024-2030

Chapter 8. Radar Sensors Market – By End User

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Aerospace and Defense

8.4 Environment and Weather Monitoring

8.5 Industrial

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End User

8.8 Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 9. Radar Sensors Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Device Type

9.1.3 By Range :

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Device Type

9.2.3 By Range :

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Device Type

9.3.3 By Range :

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Device Type

9.4.3 By Range :

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Device Type

9.5.3 By Range :

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Radar Sensors Market – Company Profiles – (Overview, By Device Type Portfolio, Financials, Strategies & Developments)

10.1 Texas Instruments

10.2 Infineon Technologies

10.3 NXP Semiconductors

10.4 Analog Devices

10.5 STMicroelectronics

10.6 Bosch Sensortec

10.7 Qualcomm Technologies

10.8 Honeywell International Inc.

10.9 Continental AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Radar Sensors Market size is valued at USD 13.11 billion in 2023.

The worldwide Global Radar Sensors Market growth is estimated to be 13% from 2024 to 2030.

The Global Radar Sensors Market is segmented By Device Type (Imaging, Non-imaging), By Range (Short range, Medium range, Long range), and By End User (Automotive, Aerospace and Defense, Environment and Weather Monitoring, Industrial, Others).

The growing demand for IoT applications, smart cities, and autonomous vehicles is expected to propel the expansion of the global radar sensors market. Advancements in the defence and aerospace sectors, along with the integration of AI and innovations in radar technology, present profitable prospects that propel market growth.

The COVID-19 epidemic caused supply chain difficulties and project delays, which in turn affected the global radar sensors market. But as the need for contactless technology in surveillance and healthcare has grown, so has innovation, which has helped the market become more resilient and adaptable.