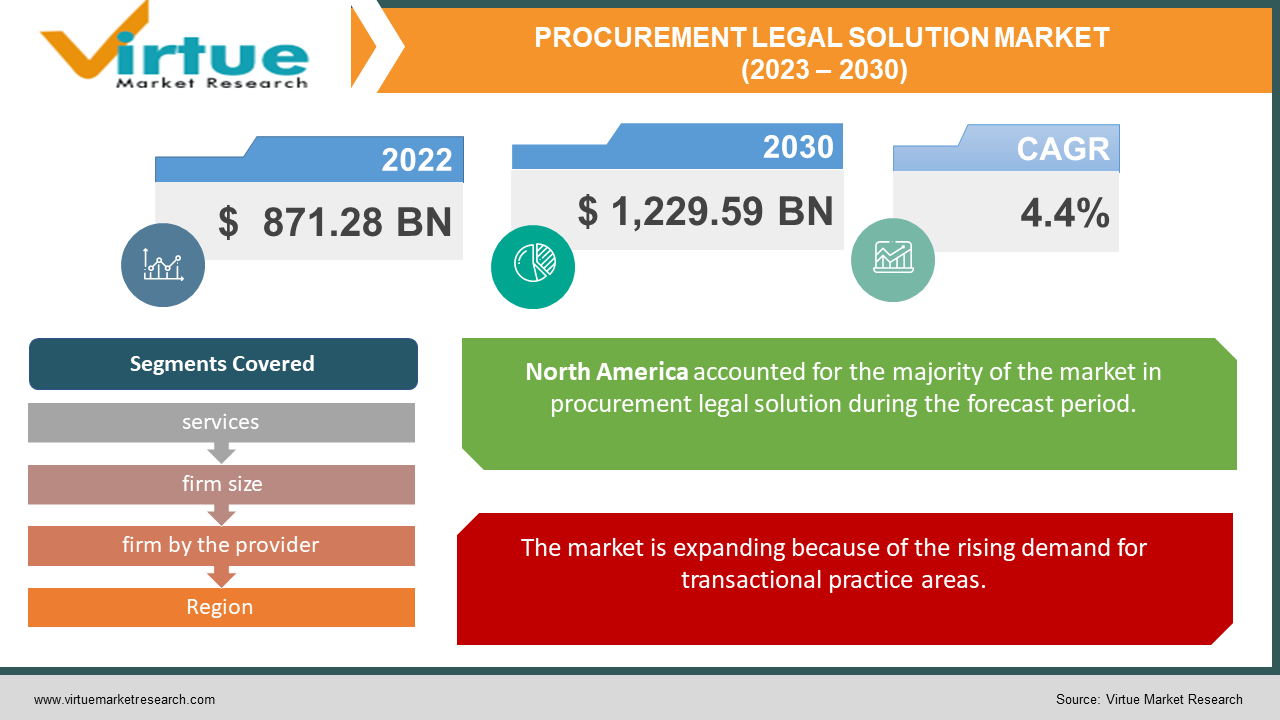

Procurement legal solution market size (2023 – 2030)

In 2022, the Global Procurement Legal Solution Market was valued at $871.28 Billion, and is projected to reach a market size of $1,229.59 Billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 4.4%.

Market Overview

Professionals can use advanced technologies like AI and Machine Learning (ML) to automate various processes and focus their time and resources on more important legal tasks. These technologies aid businesses in the drafting and assessment of contracts, as well as the finding and due diligence of documents. Big data analytics is predicted to have a bright future as well. As a result, companies like InvestCEE Tanacsado Kft., FiscalNote, and Ravel legal have sprung up to provide advanced analytical insights to their clients.

Legal library apps like LawSauce, NotaryCam, and iLegal Legislation have become popular, allowing users and professionals to acquire legal services quickly and easily. In-house digital strategies are also available from service providers to modify and improve a company's procedures and activities.

Law firms may improve their ability to minimise risk, optimise delivery, forecast outcomes, and personalise solutions to consumer expectations by applying AI and machine learning to big datasets.

Furthermore, law companies and legal departments have been steadily increasing their use of cloud technology. Cloud computing is becoming a safer place to manage crucial files and customer information as tougher rules and regulations are implemented. Cloud computing also makes it easier to set up a practice management software that allows clients to view documents through a client portal. The most popular legal-specific cloud service providers are Clio, MyCase, and NetDocuments.

Covid-19 Impact on Procurement legal solution market

The spread of COVID-19 is projected to have a detrimental influence on the procurement legal solutions sector. Closures of legal firms, a slowdown in services, the absence of clients, client cancellation of appointments and agreements, a drop in the available staff owing to illness or isolation, and difficulty holding specialised meetings and services were all issues that the market encountered. According to a Clio study, almost 77 per cent of legal professionals asked said COVID caused a disturbance in their daily activities. Around 56% of legal professionals questioned reported a significant drop in the number of people contacting their firm for legal help. However, because the shock was a "black swan" incident unrelated to continuing or structural flaws in the market or the global economy, it is projected that the legal services market will recover over the forecast period.

MARKET DRIVERS

The market is expanding because of the rising demand for transactional practice areas.

The legal solutions industry is likely to be driven by an increase in transactional practices throughout the forecast period. For people and organisations, transactional practice comprises the investigation, preparation, and evaluation of papers for corporate, tax, and real estate activities, as well as mergers and acquisitions. Pharmaceutical companies seeking new opportunities to enhance their product portfolios due to the patent expiration of popular drugs in 2023-20261 are expected to increase the number of mergers and acquisitions in several industries, including pharmaceutical, accounting, and technology, during the forecast period. One of the anticipated acquisitions is Celgene, an American biotechnology business, by Bristol-Myers Squibb, a worldwide biopharmaceutical corporation based in the United States, to build a premier biopharmaceutical company focused on oncology, immunology, inflammation, and cardiovascular disease. 2. Another significant transaction was Vista Equity Partners' $3.5 billion purchase of Pluralsight, an online training course provider. 3 The predicted increase in M&A activity in Saudi Arabia can be ascribed to government measures to diversify the Kingdom's economy and loosen foreign direct investment policies, which are supported by the Vision 2030 economic reform. 4. The legal solutions market is likely to be driven by an increase in M&A activity across industries and nations.

Market opportunities are being created globally as a result of changes in political structure, legal reforms, and trade agreements.

International businesses and organisations must abide by a variety of national laws and regulations, as well as special trade agreements. The demand for legal services is increasing as the legal framework of intrastate agreements changes. Because of the intricacy of the regulatory and legislative changes in the jurisdiction, judicial structure, and trade, the United Kingdom's exit from the European Union is projected to raise demand for legal services.

MARKET RESTRAINTS

Market growth is being stifled by rising costs and shrinking margins.

Economic growth will result in salary rises as well as a scarcity of competent employees in a skilled labor-intensive businesses like legal services. These rising input prices will put pressure on legal services firms that want to safeguard margins while maintaining service quality. According to a survey by Altman Weil, 95.4 per cent of law firms believed price competitiveness was a significant trend influencing the Procurement legal solutions market and affecting their profit margins. 5 The legal services sector is projected to be constrained by rising costs.

Market growth is being stifled by new complexity and covid-19 impact

In the legal services business, increasing demand to embrace alternative fees to bring transparency to billing methods is operating as a restraint. A disincentive is increased budgetary pressure to cut outside counsel expenses. In 2020, the outbreak of Coronavirus illness (COVID-19) acted as a limitation on the legal services industry, as governments around the world enforced lockdowns and trade restrictions, restricting the need for professional services.

PROCUREMENT LEGAL SOLUTION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.4% |

|

Segments Covered |

By services, firm size, firm by the provider, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Baker & McKenzie, Clifford Chance LLP, Deloitte, and DLA Piper |

Procurement legal solution market - by services

-

Taxation

-

Real Estate

-

Litigation

-

Bankruptcy

-

Labor/Employment

-

Corporate

In 2021, the corporate category dominated the legal services industry, accounting for 29.2 per cent of global revenue. The introduction of new ways of financial transactions on business fronts can be linked to this high share. Furthermore, since conflicts over organisational discrimination and harassment of employees, audits, patent infringement and copyright violation continue to rise, the corporate segment is likely to remain the dominating service category over the forecast period. The segment's growth is expected to be aided by rising demand for intellectual property-related services in the business sector.

As commercial organisations continue to spend considerable lawsuit management expenses, the litigation segment had a significant revenue share in 2021. Moreover, third-party litigation funding and legal financing service providers are increasingly diversifying their jurisdictions and growing their global capability. This has created opportunities for litigation service providers in particular. In both developing and developed countries, the application of strict rules in areas such as Intellectual Property (IP) protection and labour relations has contributed to the demand for litigation services.

Procurement legal solution market - by firm size

-

Large firms

-

Small and medium-sized

In 2021, the large businesses category dominated the market, accounting for 38.9% of global sales. The vast range of services provided by major enterprises accounts for this high percentage. Large firms, for example, handle the majority of judicial work, including criminal defence, large-scale litigation, and substantial corporate transactions for companies in several industries. Large organisations' increased demand for corporate judicial services is expected to drive the large businesses segment's rise during the forecast period.

In addition, small and medium-sized legal services organisations are expanding globally by creating offices all over the world and hiring attorneys from all over the world. These firms are primarily targeting overseas clientele to assist them in managing their legal requirements. They're also expanding their global consumer base by providing high-end specialist services that involve sophisticated transactions. As a result, throughout the projected period, the small and medium business categories are expected to gradually gain a significant revenue share.

Procurement legal solution market - by the firm by the provider

-

Private Practicing Attorneys

-

Legal Business Firms

-

Government Departments

-

Others

In 2021, the legal business companies category dominated the market, accounting for 46.2 per cent of global sales. This high percentage can be due to legal service providers' strategic investments. They're investing in pipeline management, client education, public relations, and local community activities as part of their business development strategy. Over the projection period, this segment is likewise expected to increase significantly. Due to the market's stagnant growth over the years, some businesses have begun to cut costs or raise rates to maintain profitability.

Procurement legal solution market - by region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

In 2021, North America dominated the market, accounting for 42.5 per cent of worldwide revenue. This high percentage can be attributable to rising assignment loads in corporate legal departments in the United States. Because of the abundance of legal service providers, the United States has emerged as the top country in the North American market. Furthermore, the region's increasing mergers and acquisitions are adding to the demand for these services.

In 2021, Asia Pacific accounted for a significant share of the market, owing to the rapid implementation of regulatory and legal requirements, particularly in China and India. In India, for example, legal service providers have begun to offer sophisticated cross-border judicial services to their business clients, resulting in enormous growth potential for the country. Service providers such as Allen & Overy LLP, Venable LLP, and Baker & McKenzie have also established a presence in India, which is expected to contribute to the expansion of the regional industry.

Procurement legal solution market by company

Market participants are concentrating on growing their consumer base and acquiring a competitive advantage over their competitors. Partnerships, mergers & acquisitions, collaborations, and new product/technology development are among the strategic goals they are pursuing. For example, Clifford Chance, a multinational law firm based in the United Kingdom, reaffirmed its global collaboration with the WEFCOS (Women's Forum for the Economy and Society) in November 2020.

-

Baker & McKenzie

-

Clifford Chance LLP

-

Deloitte

-

DLA Piper

NOTABLE HAPPENINGS IN THE PROCUREMENT LEGAL SOLUTION MARKET IN THE RECENT PAST:

EXPANSION

-

In April 2021, Kirkland and Ellis opened their third location in Texas. The company's total number of locations has expanded to 17 as a result of this expansion. The ten offices are located in the United States, with three in Asia and four in Europe.

PARTNERSHIP

-

In January 2021, Latham and Watkins appointed a new partner in Tokyo who would focus on Japanese law. Hiroaki Takagi joins from Nishimura & Asahi, where he served as a partner advising on securities and business transactions.

-

In January 2020, Baker McKenzie, a multinational law firm based in the United States, worked with SparkBeyond, an AI-based problem-solving platform provider to deploy SparkBeyond's technology to disrupt the sector. This technology is supposed to assist legal firms in predicting what services their customers will require.

Chapter 1. PROCUREMENT LEGAL SOLUTION MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. PROCUREMENT LEGAL SOLUTION MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. PROCUREMENT LEGAL SOLUTION MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. PROCUREMENT LEGAL SOLUTION MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. PROCUREMENT LEGAL SOLUTION MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. PROCUREMENT LEGAL SOLUTION MARKET– By Component

6.1. Software

6.2. Services

Chapter 7. PROCUREMENT LEGAL SOLUTION MARKET– By Deployment Model

7.1. On-premise

7.2. Cloud-based

Chapter 8. PROCUREMENT LEGAL SOLUTION MARKET– By Organization Size

8.1. Large Enterprises

8.2. Small and Medium-sized Enterprises (SMEs)

Chapter 9. PROCUREMENT LEGAL SOLUTION MARKET– By Application

9.1. Contract Management

9.2. Spend Analysis

9.3. Supplier Management

9.4. E-sourcing

9.5. Others

Chapter 10. PROCUREMENT LEGAL SOLUTION MARKET– By Region

10.1. North America

10.2. Europe

10.3. The Asia Pacific

10.4. Latin America

10.5. Middle-East and Africa

Chapter 11. PROCUREMENT LEGAL SOLUTION MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. Company 1

11.2. Company 2

11.3. Company 3

11.4. Company 4

11.5. Company 5

11.6. Company 6

11.7. Company 7

11.8. Company 8

11.9. Company 9

11.10. Company 10

Download Sample

Choose License Type

2500

4250

5250

6900