Micro Fulfilment Software Market Size (2024 – 2030)

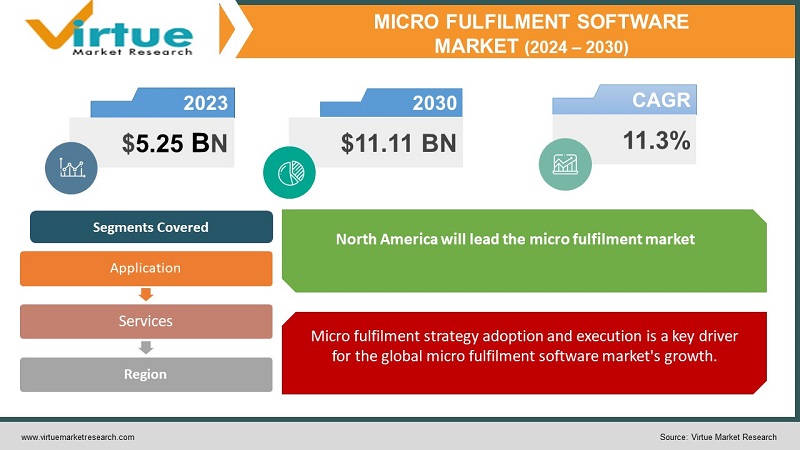

Global Micro Fulfillment Software Market was valued at USD 5.25 billion and is projected to reach a market size of USD 11.11 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.3%.

Market Overview

Micro fulfilment is an excellent method used by retailers to make the fulfilment process more efficient, from receiving an online purchase to packing it and, in certain situations, delivering last-mile delivery. Its strategy focuses on combining the efficiency of huge, automated warehouses with the speed of localised, in-store pick-up. Micro fulfilment technology entails the use of highly automated and compact storage facilities close to the client, reducing delivery time and cost. Micro fulfilment is a software management system and physical infrastructure that aids in order processing and item retrieval from storage before being packaged and transported. Last-mile delivery to a customer's address is sometimes included in micro fulfilment services. As demand for e-grocery services develops, the insides of this mini fulfilment centre have become the ultimate solution for grocers looking to bring fulfilment closer to customers for curbside pickup or home delivery.

Covid-19 Impact on Micro fulfilment software market

Because of the growing use of e-commerce platforms around the world, Covid 19 has had a favourable impact on the Micro fulfilment market. Consumers prefer internet buying because of government rules and regulations. As a result, a growing number of eCommerce businesses have adopted the micro fulfilment approach to experiment with novel ways to fulfil orders and become closer to customers, which is critical for establishing a competitive advantage. Last year, for example, grocery retailer Woolworths announced an exclusive partnership with Takeoff Technologies of the United States to build automated micro-fulfilment centres in or near existing stores, as well as commitments to double its online capacity in response to the massive increase in online demand. As a result, the micro fulfilment industry is projected to have a favourable impact on growth and is expected to develop in the future.

MARKET DRIVERS

Micro fulfilment strategy adoption and execution is a key driver for the global micro fulfilment software market's growth.

E-commerce brands have clearly taken over brick-and-mortar stores since the commencement of the COVID-19 pandemic. The popularity of online purchasing has exploded. As a result, in order to meet the growing demand, businesses must expand their e-commerce capabilities, including micro fulfilment strategies, as this hybrid model allows them to get closer to customers more readily. Several retailers, including Amazon, Walmart, Kroger, Ocado, Woolworths, Carrefour, H-E-B, Albertsons, Uniqlo, Meijer, and others, have already begun to embrace and apply innovative technologies like micro fulfilment in the event of a pandemic.

The market is expanding due to an increase in demand for same-day delivery.

Many e-commerce companies are experimenting with micro-fulfilment centres in response to the growing demand for same-day deliveries. A large number of customers expect same-day delivery of their goods or items. According to Invesp, a prominent provider of eCommerce conversion rate optimization software and services, approximately 56 per cent of online shoppers aged 18 to 34 demand same-day delivery, with approximately 61 per cent willing to pay a premium for same-day delivery. This has enhanced firms' micro fulfilment techniques, which is propelling the industry forward.

MARKET RESTRAINTS

The supply chain's complexity is impeding market expansion.

The intricacy of the supply chain has an influence on enterprises that use micro fulfilment strategies, and it is limiting the market's growth. Complexity in the supply chain is defined by its abundance, interdependency, variability, variety, and unpredictability. These aspects of complexity are intertwined. For example, a lot of diversity might lead to a lot of variabilities or a lot of density. In the same way, diversity can lead to uncertainty. However, as micro-fulfilment centres mature, they will be embraced by fast-growing e-commerce industries such as fashion, healthcare, and others, creating a new opportunity for market growth during the projection period.

Lack of awareness and a high implementation cost stymie adoption.

Micro fulfilment software is in high demand all around the world. On the other hand, many small and medium-sized firms are still ignorant of the advantages of micro fulfilment software. This factor is limiting the market's total growth. Small and medium-sized firms, on the other hand, are being held back by high setup and implementation expenses.

This research report is based on the Micro fulfilment software market is segmented and sub-segmented by service type, application and region.

MICRO FULFILMENT SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.3% |

|

Segments Covered |

By Services, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Service portfolio extension, Addverb Technologies, Swisslog, Alert Innovation, Dematic, Fabric, Attabotics, Opex Corporation, Vanderlande, TGW, Autostore, Ocado, Honeywell Intelligrated, Take off Technologies, and Exotic Solutions |

Micro fulfilment software market by service

- warehousing & storage fulfilment services

- bundling fulfilment services

- shipping fulfilment services

- others

The global market has been segmented into warehousing & storage fulfilment services, bundling fulfilment services, shipping fulfilment services, and others based on service types. In 2021, the shipping fulfilment service category dominated the market, accounting for more than 35.6 per cent of global revenue. Increased commerce and shipping activity have emerged from trade liberalisation legislation and cross-border shipment agreements. With the growth of the e-commerce industry, e-commerce businesses choose to outsource shipping to third-party service providers so they may focus on other important business operations.

As a result, shipping services have the highest revenue share in the market. In 2021, the warehousing and storage fulfilment service category had a significant revenue share. As players in the online sales market around the world continue to outsource these services in order to reduce delivery time, the introduction and adoption of automated robots and Augmented Reality (AR) technology in warehouses is significantly improving operational efficiency and, as a result, contributing to segment growth.

Micro fulfilment software market by application

- Grocery

- Automotive

- clothing and footwear

- Consumer Electronics

- others

From 2023 - 2030, the consumer electronics industry is predicted to increase at the quickest rate, with a CAGR of 11.8 per cent. The increase is due to the rising demand for consumer electronics, as well as the requirement for delicate devices to be handled with care. Mobile phones, tablets, and televisions, among other consumer devices, typically require unique packaging. Because most consumer electronics are extremely fragile, they must be packed with care to minimise the chance of damage. Furthermore, the shipping boxes/cartons should be well sealed to prevent moisture from entering and causing product defects. Not only do fulfilment centres handle packaging requirements, but they also provide bundling and assembly services. Accessories are included with a number of electronic items.

Furthermore, in 2021, the clothes and footwear segment had the biggest market share. Clothing and footwear had the largest sales among all the product categories offered on e-commerce platforms in 2021.

Micro fulfilment software market by region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Over the projection period, North America will lead the micro fulfilment market, followed by Europe. In the North American region, the United States is the top country in terms of recent micro fulfilment strategy development. For example, the AutoStore Company in the United States is an ancient and proven technology with hundreds of eCommerce fulfilment installations, including a recent partnership with Swisslog and H-E-B for a mini fulfilment centre in the United States.

Due to recent advances in micro fulfilment technologies in their eCommerce industry, Europe is predicted to be the second-largest region in the micro fulfilment market. Furthermore, in the European region, automation in many industries such as grocery, food & drinks, retail, and others has prompted a lot of eCommerce centres to focus on this micro fulfilment strategy. This has also fuelled the expansion of the micro fulfilment sector in Europe.

Due to the existence of high-growth economies such as China, India, and the Philippines, the Asia Pacific is expected to be the most promising area throughout the forecast period. Consumer spending power is expanding in emerging countries, resulting in an increase in demand for end-use products. This has a favourable impact on demand for a continuous supply of items to consumers. The development of micro fulfilment software systems and increased awareness of cloud-based warehouse management systems are two major factors driving the market in Europe.

Micro fulfilment software market by company

- Service portfolio extension

- Addverb Technologies

- wisslog

- Alert Innovation

- Dematic

- Fabric

- Attabotics

- Opex Corporation

- Vanderlande

- TGW

- Autostore

- Ocado

- Honeywell Intelligrated

- Take off Technologies

- Exotic Solutions

are the top key players in the Micro fulfilment software market.

Micro fulfilment service companies' primary objective is to expand their service portfolios. For example, United Parcel Service of America, Inc. launched a new e-fulfilment platform in February 2020. This new platform connects Amazon.com, Inc., eBay Inc., and Etsy, Inc.'s fulfilment service centres to small and medium-sized enterprises on 21 online marketplaces.

Businesses may manage their orders and inventory across several marketplaces using the platform from a single location. Consumers throughout the world are growing more demanding in terms of service, particularly in terms of lead time and delivery costs. in order to cater

NOTABLE HAPPENINGS IN THE MICRO FULFILMENT SOFTWARE MARKET IN THE RECENT PAST:

PRODUCT LAUNCH

- In March 2021, Mediterranean Shipping Co. announced a "Suspension of Transit" (SOT) campaign across Asia-Pacific, the Middle East, the Americas, and Europe. Beneficial cargo owners (BCOs) and cargo consolidators who want quick container storage capacity will benefit from the service.

- In March 2021, Amazon.com Inc. introduced a series of micro fulfilment service channels closer to major US cities, cutting delivery times by hours. For retailers in Phoenix, Philadelphia, Dallas, and Orlando, the company concentrates on same-day delivery operations.

EXPANSION

- In January 2021, DHL announced plans to develop its warehouse and supply chain businesses in India. As the German logistics company looks to grow its warehouse and supply chain capacity in India, DHL will shortly make a big investment.

Chapter 1. MICRO FULFILMENT SOFTWARE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MICRO FULFILMENT SOFTWARE MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. MICRO FULFILMENT SOFTWARE MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. MICRO FULFILMENT SOFTWARE MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.MICRO FULFILMENT SOFTWARE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MICRO FULFILMENT SOFTWARE MARKET – By service

6.1. warehousing & storage fulfilment services

6.2. bundling fulfilment services

6.3. shipping fulfilment services

6.4. others

Chapter 7. MICRO FULFILMENT SOFTWARE MARKET – By application

7.1. Grocery

7.2. Automotive

7.3. clothing and footwear

7.4. Consumer Electronics

7.5. others

Chapter 8. MICRO FULFILMENT SOFTWARE MARKET – By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. MICRO FULFILMENT SOFTWARE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Service portfolio extension

9.2. Addverb Technologies

9.3. Swisslog

9.4. Alert Innovation

9.5. Dematic

9.6. Attabotics

9.7. Opex Corporation

9.8. Vanderlande

9.9. TGW

9.10. Autostore

9.11. Ocado

9.12. Honeywell Intelligrated

9.13. Take off Technologies

9.14. Exotic Solutions

Download Sample

Choose License Type

2500

4250

5250

6900