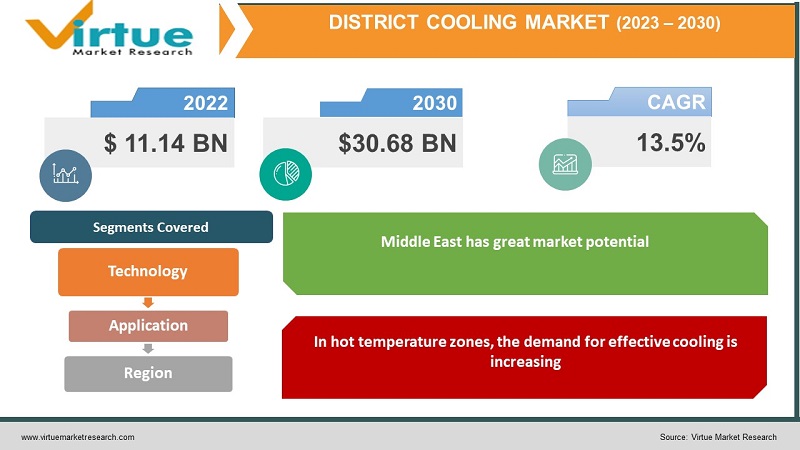

District Cooling Market Size (2022 – 2030)

According to our research report, the global district cooling market size is at USD 11.14 billion in 2022 and is estimated to reach a total market valuation of USD 30.68 Billion by 2030. The market is projected to grow with a CAGR of 13.5% per annum during the period of analysis (2023 - 2030).

Industry Overview

A district cooling system involves the production and delivery of chilled water from a central location to multiple structures such as offices, residences, and factories via an underground insulated conduit. District cooling is used to cool the indoor air of buildings located inside the district, such as airports, military sites, university campuses, and downtown commercial areas. District cooling is an environmentally beneficial and cost-effective approach that is widely endorsed by governments, resulting in increased demand for district cooling across the world.

Over the next several years, the industry is projected to be driven by rigorous government regulations to minimize greenhouse gas emissions, as well as fast changes in meteorological conditions. In addition, growing awareness of the advantages of district cooling, such as lower energy consumption compared to traditional dispersed air conditioning, is expected to increase the industry in the future years.

Furthermore, the growing demand for district cooling systems as a result of increased urbanization represents a growth potential for the market throughout the projection period. Several constraints and hurdles might stifle market expansion. The hefty initial expenditure, as well as the difficulties encountered throughout the district cooling system's deployment.

Impact of Covid-19 on the Industry

COVID-19 has hurt the worldwide district cooling sector. Due to the epidemic, the need for district cooling has decreased. Governments throughout the world have been forced to curtail commercial activity to prevent the spread of COVID-19. Companies throughout the globe were forced to shut down their manufacturing facilities and services as a result of partial or complete lockdowns imposed to stop the virus from spreading. As a result of the lack of raw materials, raw material procurement costs increased, causing order closures to be delayed. As a result, the pandemic has had a short-term detrimental influence on the demand for district cooling.

Market Drivers

In hot temperature zones, the demand for effective cooling is increasing

The population of tropical and hot temperature zones requires cooling to be more comfortable, particularly during the summer. Air conditioner ownership is growing in certain areas, according to the International Energy Agency (IEA). One of the most advanced markets for district cooling in the Middle East. In the summer, the temperature in the Middle East has risen to over 50 degrees Celsius. Cooling is one of the most serious problems that these countries confront. Between midday and 5 p.m. in the summer, the Dubai Power and Water Authority report a 40% increase in demand for electricity, primarily for cooling. During the summer, cooling accounts for 70% of the region's energy requirement. District cooling is an efficient alternative to energy-intensive traditional cooling techniques.

According to the International Energy Agency, worldwide energy consumption for space cooling increased by 60% between 2015 and 2020. When compared to traditional air conditioning, district cooling helps minimize the use of ecologically harmful refrigerants like hydrochlorofluorocarbons (HCFCs) and hydrofluorocarbons (HFCs). The primary district cooling markets in the Middle East include Saudi Arabia, the United Arab Emirates, Qatar, Bahrain, Oman, and Kuwait. The desire to save energy and the region's intense heat are two main factors that are predicted to drive up demand for energy-efficient conditioning.

Demand for energy-efficient and environmentally friendly cooling technology is increasing

The majority of energy use occurs in buildings. As a result, energy-efficient structures are required. Buildings must lower their energy use under the new building regulations. Eurocodes, for example, guarantee that buildings are both sustainable and compliant with the established codes in Europe. The International Code Council's International Energy Conservation Code also requires buildings to be energy efficient.

Because of increased affluence and urbanization, the need for cooling is increasing. The need for district cooling is predicted to increase as energy prices rise, environmental concerns develop, and the desire for low-cost, high-efficiency cooling systems grows. District cooling facilities utilize far less water and energy than central cooling plants, resulting in greater environmental advantages. A centralized plant produces cooling, which is more efficient than individual air-conditioning units.

Market Restraints

High initial investment and a longer payback time

District cooling is a capital-intensive and time-intensive process that necessitates extensive planning. The distribution network's installation is likewise costly. For district cooling, a large-scale centralized cooling generation and distribution infrastructure is required. As a result, large capital expenditures (CAPEX) for manufacturing and distribution are required. Lower operational expenses must compensate for the significant construction expenditure. Different production technologies can be utilized to reduce operating expenditures (OPEX) in a centralized facility. The installation of the distribution system takes up around half of the overall cost. As a result, district cooling is cost-effective in locations with high cooling demand density but prohibitively expensive in low-density areas. District cooling has a higher rate of return on investment and is only suited for certain applications.

Difficulties encountered during district cooling system implementation

The locations that require district cooling plants and piping are huge, and district cooling plant development is done in phases over a lengthy period. As a result, there are connections to other infrastructure, notably in the chilled and condensing water pipeworks. In such instances, interfacing issues are prevalent and might occur even on a greenfield site. To solve these interface challenges and reduce construction difficulty, an integrated planning strategy is necessary. The lack of available area for operating construction equipment is a key construction issue while installing a district cooling system. Moving equipment to a certain area and coordination among contractors are two further building issues.

District Cooling Market Report Coverage:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

13.35% |

|

Segments Covered |

By Technology, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

National Central Cooling Company PJSC, Emirates Central Cooling System Corporation, Emirates District Cooling, LLC, Qatar District Cooling Company |

This research report on the global district cooler market has been segmented and sub-segmented based on Technology, Application, Geography & region.

Global District Cooling Market- By Technology

- Free Cooling

- Absorption Cooling

- Electric Chillers

The market is divided into three categories based on technology: free cooling, absorption cooling, and electric chillers. Absorption cooling is predicted to have the biggest market share since it minimizes the need for electrically powered cooling in the energy system while simultaneously lowering carbon dioxide emissions.

The use of various DC technologies can assist businesses in completing large-scale projects effectively and on schedule. Electric chillers and absorption chillers are two examples of well-known technology. Electric chillers, on the other hand, are favored because of their higher co-efficient performance. These chillers require 50% less floor area than absorption chillers, which increases their acceptance.

Global District Cooling Market- By Application

- Residential

- Commercial

- Industrial

The market is divided into three categories: residential, commercial, and industrial. In the foreseeable timeframe, the Residential category is expected to have the greatest CAGR. The issues include increased pollution from intensive building operations, rising world temperatures, and rising cooling demand as a result of past climate change.

In 2020, the commercial category held a commanding proportion of the market. This system is most commonly seen in commercial structures such as offices, stores, government, institutions, airports, and organizations. Because of the growth in global temperature, this technology has become an essential component of commercial construction.

The growing requirement for air conditioning in residential buildings has fueled demand for these systems. The residential segment is expected to be driven by a large number of residential development projects and increased public knowledge about renewable and efficient energy sources over the forecast period.

Global District Cooling Market- By Geography & region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

In 2020, the Middle East and Africa were worth USD 9.28 billion. Because of the region's hot climatic conditions, the Middle East has great market potential. The UAE is a key nation in the Middle East and Africa market in terms of installed capacity. The market in this area is being driven by expanding awareness of net-zero energy (NZE) buildings and an increasing number of nations having NZE buildings.

The market in Qatar is expanding as a result of economic diversification for the FIFA World Cup 2022. The government is investing extensively in the construction of world-class facilities for the 2022 World Cup in Qatar. In the next years, such initiatives are projected to boost the worldwide market growth. In the Middle East and Africa, significant service providers include Emirates Central Cooling Systems Corporation (EMPOWER), Emirates District Cooling (Emicool), Marafeq Qatar, and Tabreed.

There has been a wide range of policy-related and programmatic actions in North America to address energy efficiency in existing and new buildings. Energy-efficient retrofit policies for existing buildings result in 20-40% reductions in building energy usage, greater energy security, decreased hazardous gas emissions, and lower need for new energy production and delivery. Nearly 400 systems serve cities and colleges across North America, according to the International District Energy Association (IDEA).

Asia Pacific's largest markets are Japan, China, Malaysia, Singapore, India, and South Korea. The Indian government has planned ambitious initiatives such as Smart Cities and Smart Grid, which are expected to propel the country's market in the next years.

Global District Cooling Market- By Companies

- National Central Cooling Company PJSC (BREED) (UAE)

- Emirates Central Cooling System Corporation (EMPOWER)(UAE)

- Emirates District Cooling, LLC (EMICOOL) (UAE)

- Qatar District Cooling Company (QATAR COOL) (Qatar).

NOTABLE HAPPENINGS IN THE GLOBAL DISTRICT COOLING MARKET IN THE RECENT PAST:

- Business Partnership: - In December 2021, Tabreed has completed a substantial strategic agreement with the International Finance Corporation (IFC), a World Bank Group member and the leading global development agency focused on the private sector in emerging nations. IFC has spent more than USD 321 billion in emerging economies since its inception in 1956.

- Merger & Acquisition: - In November 2021, Empower signed an agreement to acquire Dubai International Airport's district cooling systems, with a total cooling capacity of 110,000 refrigeration tonnes (RT), for AED 1.1 billion, using a combination of internal accruals and debt financing from local and international banks with which Empower has close strategic relationships.

- Business Partnership: - In September 2021, Empower announced a new agreement with Mitsubishi Heavy Industries Thermal Technologies to use Mitsubishi's breakthrough air-conditioning and heating systems, which will result in a qualitative jump in Empower's ecologically friendly district cooling operations.

Chapter 1. GLOBAL DISTRICT COOLING MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL DISTRICT COOLING MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. GLOBAL DISTRICT COOLING MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. GLOBAL DISTRICT COOLING MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.GLOBAL DISTRICT COOLING MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL DISTRICT COOLING MARKET– By Production Technique

6.1. Free Cooling

6.2. Absorption Cooling

6.3. Electric Chiller

Chapter 7. GLOBAL DISTRICT COOLING MARKET– By Application

7.1. Commercial

7.2. Residential

7.3. Industrial

Chapter 8. GLOBAL DISTRICT COOLING MARKET– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. GLOBAL DISTRICT COOLING MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Company 1

9.2. Company 2

9.3. Company 3

9.4. Company 4

9.5. Company 5

9.6. Company 6

9.7. Company 7

9.8. Company 8

9.9. Company 9

9.10. Company 10

Download Sample

Choose License Type

2500

4250

5250

6900