Digital Oncology Therapeutics Market Size (2024 – 2030)

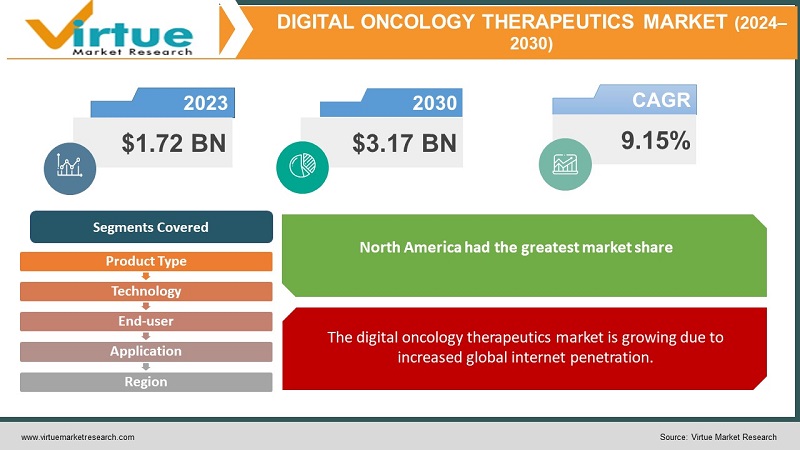

The market for Digital Oncology Therapeutics was estimated to be worth USD 1.72 billion in 2024, and it is projected to reach USD 3.17 billion by the end of 2030, growing at a CAGR of 9.15% over the forecast period.

Increased patient assistance programmes (PAPs), increased government activities for cancer awareness, rising cancer prevalence worldwide, strong R&D initiatives from key companies, and expanding demand for personalised medication are all factors driving market expansion.

Market Overview

Oncology therapeutics is the area of medicine which helps in identifying changes in cancer cells that stop or delay the growth of tumours that cause cancer in the patient's body. There are a variety of cancer treatments and therapy options available, depending on the stage and kind of cancer. Cancer treatments in clinical trials and research include targeted therapy, immunotherapy, hormone therapy, and stem cell transplant. During the projected period, the oncology treatments market is likely to benefit from rising cancer prevalence worldwide, increased cancer research, and increased government initiatives to raise cancer awareness.

According to the Globocan 2020 information sheet, there were an expected 19,292,789 new cancer cases identified globally, with about 9,958,133 cancer-related deaths. Furthermore, the International Agency for Research on Cancer (IARC) predicts that by 2040, the global burden of cancer would have increased to 27.5 million new cancer cases and 16.3 million deaths. The rising number of cancer cases is predicted to increase the demand for sophisticated cancer medicines and diagnostics to treat patients effectively along with the rise of digital technologies As a result of the aforementioned factors, the Digital Oncology Therapeutics market is predicted to rise rapidly over the forecast period.

COVID-19 Impact on the Digital Oncology Therapeutics Market

The COVID-19 pandemic has had a huge influence on worldwide healthcare systems, as well as the market for Digital Oncology Therapeutics. Doctors from Cancer Institutes discovered that during the COVID-19 pandemic, there was a 46% decline in diagnoses of the six most frequent cancer types - breast, colorectal, lung, pancreatic, gastric, and oesophagal cancers, according to a paper published in Cancer Connect 2020. In addition, the Centers for Disease Control and Prevention (CDC) and many medical professional organisations recommended that cancer screening and other health-prevention services, as well as elective surgeries, be postponed unless the risks outweighed the benefits and that hospital infrastructure for COVID-19 patients is secured. As a result, the COVID-19 pandemic greatly influenced the market for Digital Oncology Therapeutics. The situation, though, is likely to progressively improve once the economy opens up and is restored.

MARKET DRIVERS

The digital oncology therapeutics market is growing due to increased global internet penetration.

The expansion in R&D and the increased occurrence of various types of malignancies are two main factors driving the market's growth. Furthermore, targeted therapy is gaining popularity due to its ability to target cancer cells while sparing non-target cells from the toxin. Bone cancer is the most common cancer in the region, and rising occurrences of the disease, as well as efficient treatment of bone cancer cases with targeted therapy, are driving market expansion. As a result of increased regulatory approvals and an increase in the prevalence of all types of cancer, the market is estimated to grow rapidly over the forecast period.

The industry is growing because of an increase in demand for personalised medicine.

Cancer is a devastating disease that claims the lives of hundreds of thousands of people each year. Standard treatments for disease heterogeneity, such as chemotherapy or radiation, are only effective in a small percentage of patients. Tumours can have a variety of origins and may express different proteins in one case vs another. This inherent heterogeneity in cancer lends itself to a developing field of perfection and well-supported medication development (PPM). PPM data is being collected in a variety of ways to describe molecular variations between tumours. Previously, several PPM products were available to link these variances to a useful medicine. PPM cancer treatments can provide enormous benefits to patients. Therefore, with the rise of technological advancements in the sector, PPM cancer treatments are becoming more popular augmenting the global market growth.

MARKET RESTRAINTS

Patients' reluctance to use digital therapies is limiting market expansion.

Digital therapeutics suppliers face a huge issue in motivating individuals to utilise digital treatments and gain their trust. While older and underprivileged people have the highest disease susceptibility and occurrence rates, they are the least likely to employ digital treatments due to a lack of technological knowledge. Furthermore, the maximum amount of behavioural change that can be detected using digital treatments is currently unknown.

Digital treatments are clinically validated and used on self-selected or volunteer patients, but their impact on patients with resistance is still unknown. Furthermore, there is limited evidence on total patient retention and long-term outcomes for digital treatments. Many patients still rely on traditional diagnostic and treatment methods and are hesitant to try new treatments. This is a significant threat to the digital therapies sector.

DIGITAL ONCOLOGY THERAPEUTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.15% |

|

Segments Covered |

By Product Type, Technology, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amgen Inc., AstraZeneca plc, Bayer AG, Bristol-Myers Squibb Company, Pfizer Inc, Novartis AG, Johnson & Johnson |

Digital Oncology Therapeutics Segmentation:

Digital Oncology Therapeutics: By Product Type

- Digital Therapeutics (DTx)

- Digital Diagnostics and Monitoring Tools

- Digital Decision Support Systems

- Tele-oncology Solutions

The digital diagnostics and monitoring tools segment is anticipated to hold the highest market in 2022. This can be attributed to the increasing cases of cancer augmenting the need for the diagnoses and monitoring process to carry on the treatment procedures. The digital therapeutics segment is anticipated to be the fastest-growing segment due to the growing penetration of smartphone technologies and the cost-effective and efficient performance of digital technologies for healthcare providers and patients.

Digital Oncology Therapeutics: By Technology

- AI and ML

- Big Data and Analytics

- Mobile Health (mHealth) and Wearables

- Internet of Medical Things (IoMT)

- Blockchain

- Telemedicine

- VR and AR

The Artificial Intelligence (AI) and Machine Learning (ML) technology segment dominated the market and accounted for the highest market share in 2022 with a share of around 35.8%. Chemotherapy, the most commonly used cancer treatment procedure when integrated with AI technologies aids healthcare professionals in developing a tailored digital profile of patients, allowing their dose to be customized during treatment. Increased research activities for integrating AI into chemotherapy are majorly accelerating segment growth.

The mobile health and wearables segment is anticipated to be the fastest-growing segment by technology due to the increased disposable income of people and the growing adoption of digital technologies and smart electronics among people.

Digital Oncology Therapeutics: By Application

- Cancer Screening and Diagnosis

- Treatment Decision Support

- Remote Patient Monitoring

- Cancer Symptom and Side Effect Management

- Patient Engagement and Education

- Clinical Trials and Research

The cancer screening and diagnosis segment accounted for the majority of the share of the total market revenue in 2022 and is anticipated to maintain its dominance during the forecasted years as well. This is due to the rising burden of cancer cases globally and the increasing launch of digital diagnostics platforms for cancer screening.

Digital Oncology Therapeutics: By End-User

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Cancer Research Institutes

- Patients and Caregivers

- Payers and Insurers

The patient and caregiver end-user segment accounted for the highest share of around 33.0% of the total market revenue in 2022. This growth can be majorly attributed to the increased adoption of digital therapeutic solutions by patients. With the growing number of patients diagnosed with cancer, the demand for digital therapeutics is increasing. On the other hand, the growth of the hospital and clinic end-user segment may be attributed to more healthcare providers implementing digital therapeutics to deliver & support oncology therapies that are clinically proven. The segment is anticipated to grow at the fastest CAGR during the forecast period

Digital Oncology Therapeutics by Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

North America, Europe, Asia Pacific, South America, the Middle East and Africa make up the worldwide digital oncology therapeutics market. Because of the high prevalence of chronic diseases and government measures to assist technological innovation in digital therapeutics in the region, North America is estimated to be the largest market for digital therapeutics. The United States is likely to generate the most revenue in both the North American and global digital therapeutics markets. Furthermore, the US digital therapeutics market is likely to be driven by the refinement of pay structures for digital therapeutic solutions and accumulative investment in the field of digital therapeutics.

The Asia-Pacific region, on the other hand, is predicted to have immense potential for significant growth during the forecast period. The rising frequency of chronic illness, the region's growing senior population, and the rise of digital treatments are all contributing to the region's growth.

Digital Oncology Therapeutics by the company

The market for digital oncology therapeutics is fiercely competitive, with several significant firms. A few significant firms now dominate the market in terms of market share.

- Amgen Inc.

- AstraZeneca plc

- Bayer AG

- Bristol-Myers Squibb Company

- Pfizer Inc

- Novartis AG

- Johnson & Johnson

Strategic collaborations and increased investment in oncology research by significant firms help to secure their position and presence globally. GlaxoSmithKline PLC, for example, purchased TESARO Inc., an oncology-based biopharmaceutical business, in January 2020, expanding GSK's pipeline and commercial competence in cancer.

RECENT DEVELOPMENTS IN DIGITAL ONCOLOGY THERAPEUTICS

- PARTNERSHIPS AND COLLABORATIONS

In March 2021, Pear Therapeutics (US) partnered with Spectrum Health Systems. (US). Pear Therapeutics has formed a relationship with Tufts Health Plan and Spectrum Health Systems to test FDA-approved digital therapeutics to help people with substance use disorders in their recovery journeys by providing solutions for greater treatment access and care innovation.

Chapter 1. DIGITAL ONCOLOGY THERAPEUTICS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. DIGITAL ONCOLOGY THERAPEUTICS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. DIGITAL ONCOLOGY THERAPEUTICS MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. DIGITAL ONCOLOGY THERAPEUTICS MARK ET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. DIGITAL ONCOLOGY THERAPEUTICS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. DIGITAL ONCOLOGY THERAPEUTICS MARKET – By Product Type

6.1. Digital Therapeutics (DTx)

6.2. Digital Diagnostics and Monitoring Tools

6.3. Digital Decision Support Systems

6.4. Tele-oncology Solutions

Chapter 7. DIGITAL ONCOLOGY THERAPEUTICS MARKET – By Technology

7.1. AI and ML

7.2. Big Data and Analytics

7.3. Mobile Health (mHealth) and Wearables

7.4. Internet of Medical Things (IoMT)

7.5. Blockchain

7.6. Telemedicine

7.7. VR and AR

Chapter 8. DIGITAL ONCOLOGY THERAPEUTICS MARKET – By Application

8.1. Cancer Screening and Diagnosis

8.2. Treatment Decision Support

8.3. Remote Patient Monitoring

8.4. Cancer Symptom and Side Effect Management

8.5. Patient Engagement and Education

8.6. Clinical Trials and Research

Chapter 9. DIGITAL ONCOLOGY THERAPEUTICS MARKET –By End User

9.1 Hospitals and Clinics

9.2. Pharmaceutical and Biotechnology Companies

9.3. Cancer Research Institutes

9.4. Patients and Caregivers

9.5. Payers and Insurers

Chapter 10. DIGITAL ONCOLOGY THERAPEUTICS MARKET – By Region

10.1. North America

10.2. Europe

10.3.The Asia Pacific

10.4.Latin America

10.5. Middle-East and Africa

Chapter 11. DIGITAL ONCOLOGY THERAPEUTICS MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. Amgen Inc.

11.2. AstraZeneca plc

11.3. Bayer AG

11.4. Bristol-Myers Squibb Company

11.5. Pfizer Inc

11.6. Novartis AG

11.7. Johnson & Johnson

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for Digital Oncology Therapeutics was estimated to be worth USD 1.72 billion in 2024, and it is projected to reach USD 3.17 billion by the end of 2030, growing at a CAGR of 9.15% over the forecast period.

The Global Digital Oncology Therapeutics Market is driven by the growing integration and adoption of digital technologies across different industry verticals globally.

The Segments under the Global Digital Oncology Therapeutics Market by Product Type are Digital Therapeutics (DTx), Digital Diagnostics and Monitoring Tools, Digital Decision Support Systems, and Tele-oncology Solutions.

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Digital Oncology Therapeutics Market.

Amgen Inc., AstraZeneca plc, Bayer AG, and Bristol-Myers Squibb Company.are the three major leading players in the Global Digital Oncology Therapeutics Market.