Global Ceramic Lasers Market Size (2023 - 2030)

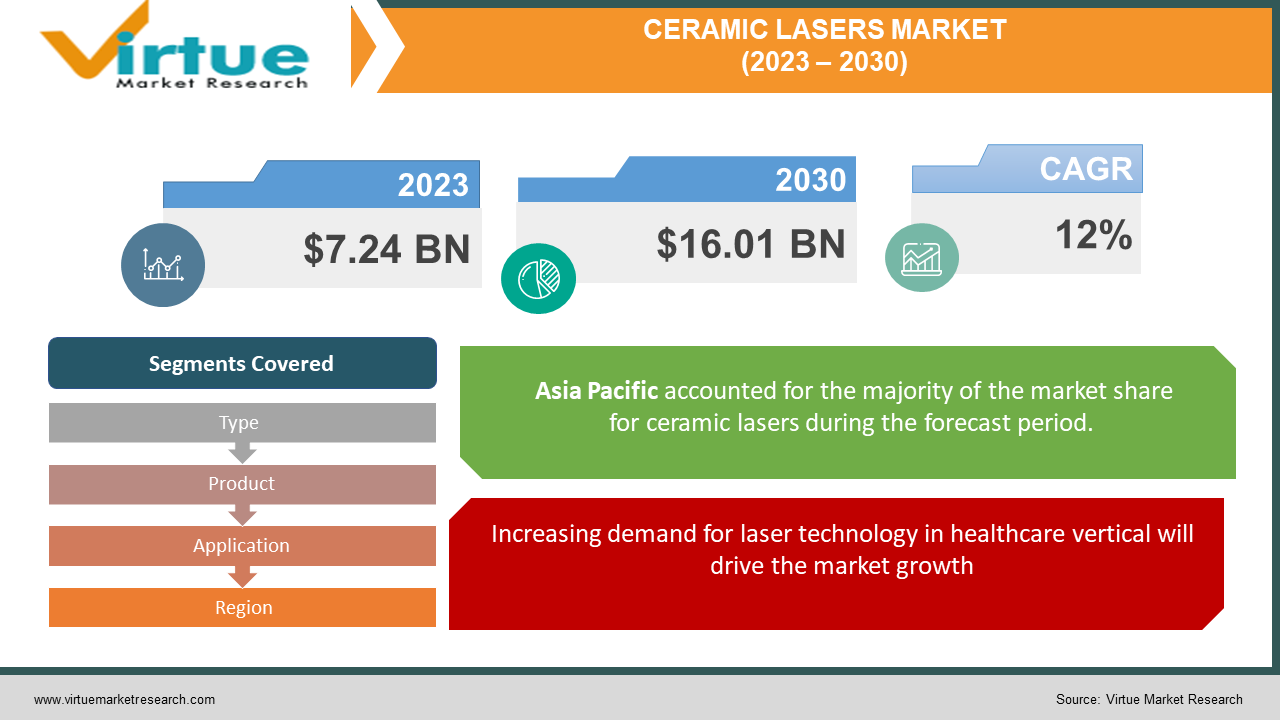

The Global Ceramic Lasers Market was valued at USD 7.24 billion and is projected to reach a market size of USD 16.01 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12%.

Industry Overview

The term "laser" refers to light amplification by radiation stimulation. It is a single-wavelength light source that has high energy and is capable of being precisely focused to transfer light to a very small region. The main uses of lasers are in the processing of materials, cosmetic surgery, and defence. Laser systems use wireless technology to transport information between two sites by using a laser beam to travel through the atmosphere. A laser beam is sent and received by the laser communication terminals (LCT). It is also possible to establish contact between planets. The laser diode is typically utilised for both feedback and the generation of a laser signal. Laser communication is then included into fiber-optic networks when fibre is not practically employed. Compared to RF, laser communication (LC) has a hundred times wider bandwidth, reduced power loss, lower power consumption, a smaller antenna, and is more secure.

Modern medical device production and quality have substantially improved thanks to the use of laser processing. The need to comply with current medical laws and compliance requirements puts ongoing pressure on manufacturers. By quickly supplying precise, trustworthy components and assemblies, lasers reduce that pressure. When designing instruments meant to be used in patient care, high levels of precision and attention to detail are essential, and laser processing offers both. The usage of laser in the medical field spans a wide range of procedures, including eye surgery, the removal of tumours, creating incisions, and aesthetic procedures.

Impact of Covid-19 on the industry

The COVID-19 pandemic is anticipated to have some negative effects on the market soon. Government-imposed lockdowns in different regions of the world have logically decreased demand. The impacted manufacturing industry, supply chain procedures, and other factors are to blame for this. Due to the pandemic, there have been supply chain interruptions that have allowed end users to have damaging consequences on the manufacturing and business processes. Additionally, researchers from all around the world have been working to create laser sensors that can quickly and accurately detect the virus from saliva or nasal swabs at the first sign of infection.

During the pandemic, increased government investment and funds raised by major businesses are estimated to fuel this industry. For instance, Santen Ventures Inc. and Rimonci Capital served as the main investors in BELKIN Laser Ltd.'s USD 12.2 million Series B financing in July 2020. The business wants to provide glaucoma sufferers with a straightforward, effective, and quick course of therapy by utilising its laser treatment.

Market Drivers

Increasing demand for laser technology in healthcare vertical will drive the market growth

Laser technology is used in urology, dermatology, dentistry, and ophthalmology within the healthcare industry. The usage of laser technology has expanded due to ongoing technical improvements to treat a wide range of medical conditions, including kidney stones, cancer, tumours, knee injuries, prostate disorders, varicose veins, heart ailments, and glaucoma. Ophthalmic laser therapy aids in the treatment of conditions affecting the eyes, including glaucoma, retinal problems, cataracts, and macular degeneration. Additionally, non-invasive medical procedures including selective laser trabeculoplasty, low-level laser therapy, photodynamic therapy, tattoo removal, and skin rejuvenation also make use of laser technology. The ageing population, improved healthcare infrastructure, rising cosmetic surgery rates, and rising prevalence of eye-related illnesses have all contributed to a growth in the sales of medical laser systems.

Increasing use of lasers for optical communication will drive the market growth

In optical communication, light is the transmission medium. Due to the fact that light waves are more densely packed than sound waves, laser technology has benefits over radio technology. With laser fibre optics, a cable is made up of numerous fibres that are each wrapped in a number of laser beams. Each laser beam has the capacity to transmit billions of data bits. As a result, laser technology has great signal quality and can carry more data per second. The use of laser technology aids in the development of cost-effective, efficient communication networks with increased bandwidth and speed. Almost all broadband communication systems employ diode lasers. As wireless connectivity utilising air as the communication channel, laser technology is increasingly being used in optical communications.

Market Restraints

High deployment cost will challenge the market growth

In addition to many other industries, the use of lasers is expanding in the automotive, semiconductor, industrial, medical, research, and defence fields. Lasers ranging from a few hundred to thousands of watts are needed for various systems, processes, and applications. Large-scale laser displays, medical and military applications, research, laser-induced nuclear fusion, and material processing (welding, drilling, soldering, labelling, and surface modification) all make use of high-power lasers. Although laser processing reduces labour costs and associated expenses in the industrial and automotive sectors, its implementation requires a significant upfront investment. Different software, design files, sturdy components, and laser sources enable lasers. To avoid costly repairs in the event of a breakdown, they often include service packages and warranties.

Environmental concerns associated with use of rare-earth elements will challenge the market growth

Using solid-state and fibre lasers to process and refine rare-earth metals like neodymium, chromium, erbium, or ytterbium presents a significant risk of radioactive contamination brought on by slurry tailings. The refining procedures make use of hazardous acids that, if handled improperly, might cause significant environmental harm. Additionally, the usage of rare-earth metals raises the possibility of short-term supply interruptions, and future implementation of renewable energy technologies may be hampered by supply issues for these metals.

GLOBAL CERAMIC LASERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

12% |

|

Segments Covered |

By Type, Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Dow Chemical Company, BASF SE, Norilsk Nickel, Mitsubishi Chemical Holdings Corporation, GrafTech International, Morgan Advanced Materials, Evonik, Universal Laser Systems, Aurubis AG, CeramTec GmbH, Anglo American, Murata Manufacturing, etc |

This research report on the global ceramic lasers market has been segmented and sub-segmented based on, type, product, application, and Geography & region.

Global Ceramic Lasers Market- By Type

- Solid

- Liquid

- Gas

- Others

Solid lasers don't waste materials in the active medium; hence they are often utilised in spectroscopy, imaging, and other research- and medical-related applications. Solid lasers are more efficient than He-Ne (Helium-Neon) and Argon lasers in terms of both continuous and pulsed output, which makes them appropriate for a variety of applications in a variety of industries, including telecommunications and automotive.

Global Ceramic Lasers Market- By Product

- Laser

- System

The usage of laser systems in a variety of industries, including industrial, commercial, automotive, and medical, is growing as a result of their capacity to carry out a wide range of tasks, including scribing, cutting, engraving, welding, and marking. The need for laser systems is furthermore being driven by a global trend of mid-sized and small firms expanding their product ranges and boosting productivity.

Global Ceramic Lasers Market- By Application

- Laser Processing

- Optical Communication

- Optoelectronic Devices

- Others (gyroscopes, rangefinders, and security systems)

The potential of laser processing to provide output that is of higher quality, more dependable, and more exact than that produced by traditional mechanical processes drives this market. The use of laser technology for material processing applications across verticals such as automotive and semiconductor & electronics is driven by the growing requirement for approaches to increase precision of material processing procedures and rising desire to minimise turn-around time.

Global Ceramic Lasers Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

The laser technology market in Asia Pacific held the highest proportion (41.4%) of the global market in 2021. When compared to other regions, Asia Pacific has been at the forefront of the adoption of laser technology goods and solutions. A significant factor influencing the adoption of laser technology for industrial processes like drilling, welding, and cutting, among others, is growing manufacturing as a result of increased industrialization in the area. Additionally, growing R&D expenditures have led to the creation of laser technologies that enable efficient signal transmission across considerable distances.

Global Ceramic Lasers Market- By Companies

-

Dow Chemical Company

-

BASF SE

-

Norilsk Nickel

-

Mitsubishi Chemical Holdings Corporation

-

GrafTech International

-

Morgan Advanced Materials

-

Evonik

-

Universal Laser Systems

-

Aurubis AG

-

CeramTec GmbH

-

Anglo American

-

Murata Manufacturing, etc

NOTABLE HAPPENINGS IN THE GLOBAL CERAMIC LASER MARKET IN THE RECENT PAST:

- Merger & Acquisition: - In 2021, Jenoptik AG announced the acquisition of BG Medical Applications GmbH. Based in Berlin, Germany, BG Medical Applications GmbH is a provider of high-precision, specialised optical components for the medical technology industry.

- Merger & Acquisition: - In 2021, Jenoptik AG announced the acquisition of SwissOptic AG. SwissOptic AG, a company with headquarters in Heerbrugg, Switzerland, is an expert in the research and production of optical components and assemblies, especially for the medical technology, semiconductor, and metrology sectors.

- Merger & acquisition: - In 2021, On March 17, 2021, Coherent Inc. revealed that the business has accepted the acquisition deal for II-VI Incorporated. In order to engage into a new merger agreement with II-VI Incorporated, Coherent Inc. is thereby terminating the merger agreement between Coherent Inc. and Lumentum that was signed on March 9, 2021, and paying Lumentum the USD 217.6 million termination fee outlined in the merger agreement.

Chapter 1. Global Ceramic Lasers Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Global Ceramic Lasers Market– Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Global Ceramic Lasers Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Global Ceramic Lasers MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Global Ceramic Lasers Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Global Ceramic Lasers Market– By Type

6.1 Introduction/Key Findings

6.2 Solid

6.3 Liquid

6.4 Gas

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Global Ceramic Lasers Market– By Product

7.1 Introduction/Key Findings

7.2 Laser

7.3 System

7.4 Y-O-Y Growth trend Analysis By Product

7.5 Absolute $ Opportunity Analysis By Product, 2023-2030

Chapter 8. Global Ceramic Lasers Market– By Application

8.1 Introduction/Key Findings

8.2 Laser Processing

8.3 Optical Communication

8.4 Optoelectronic Devices

8.5 Others (gyroscopes, rangefinders, and security systems)

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 9. Global Ceramic Lasers Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Product

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Product

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Product

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Product

9.4.4 By By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Product

9.5.4 By By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Ceramic Lasers Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Dow Chemical Company

10.2 BASF SE

10.3 Norilsk Nickel

10.4 Mitsubishi Chemical Holdings Corporation

10.5 GrafTech International

10.6 Morgan Advanced Materials

10.7 Evonik

10.8 Universal Laser Systems

10.9 Aurubis AG

10.10 CeramTec GmbH

10.11 Anglo American

10.12 Murata Manufacturing, etc

Download Sample

Choose License Type

2500

4250

5250

6900