Asia-Pacific Butanol Market Size (2023 – 2030)

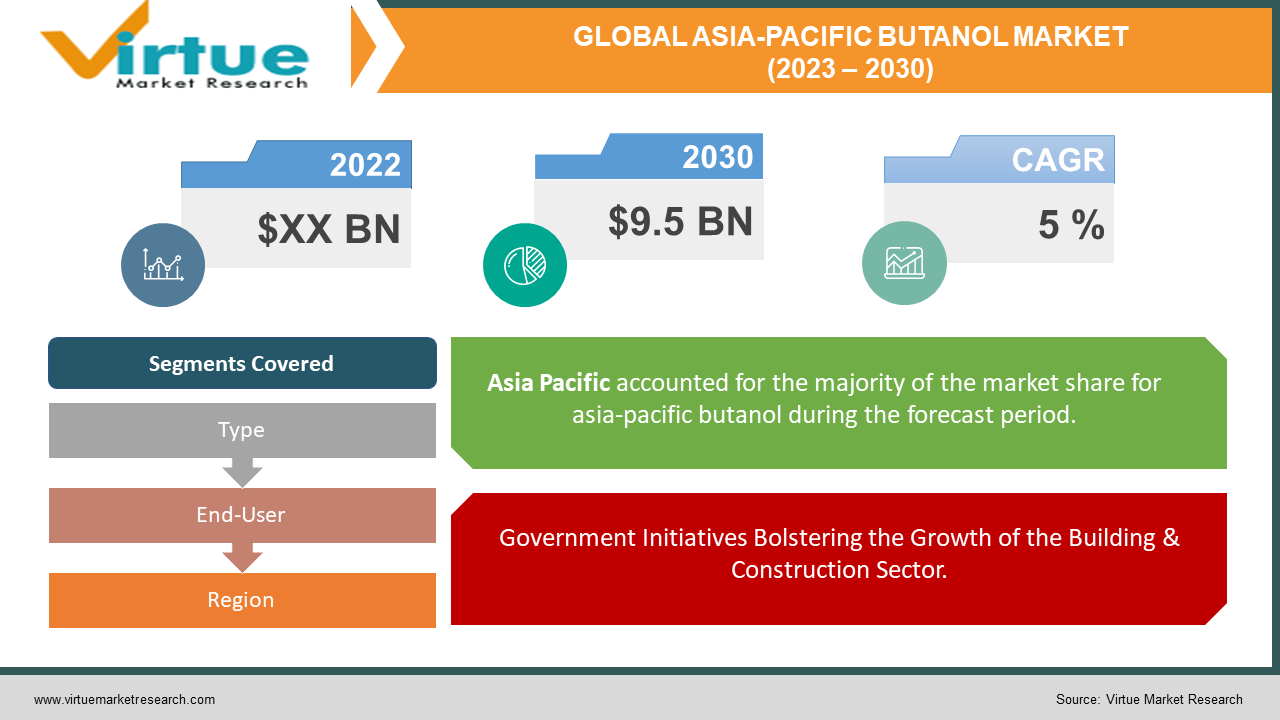

According to our research report, the Asia-pacific butanol market is estimated to reach a total market valuation of USD 9.5 billion by 2030. The market is projected to grow with a CAGR of 5% per annum during the period of analysis (2023 - 2030).

Industry Overview

Butanol is four-carbon alcohol with the chemical formula C4H9OH. The fermentation method known as acetone-butanol-ethanol (ABE) is frequently used to produce bio-based butanol. Because butanol has a higher energy density, lower hydrophilicity, and lower vapor pressure than ethanol and methanol as a biofuel, its market demand is growing. The expansion is also explained by the rising demand for paint thinners, coating resins, lubricants, rubbers, glycol ethers, butyl acrylate, plastics, and other products from the expanding building and transportation sectors in Asia-Pacific nations. Additionally, the growing demand for butanol in Asia-Pacific is anticipated to fuel the region's butanol market size rise throughout the forecast period in applications related to domestic and industrial cleaning as well as chemical intermediates.

China now controls the majority of the Asia-Pacific butanol market as a result of its expanding transportation sector. The primary drivers of the expansion of the transportation sector in China are the rising population, rising per capita income, and changing individual lifestyles. Two key factors propelling the Asia-Pacific butanol sector are its growing prominence as a component in the manufacture of chemicals and the substantial decrease in carbon emissions. Growing in favor of green substitutes for fuels derived from petroleum is biofuel based on butanol. It is chosen as a superior automobile fuel over methanol and bioethanol due to its high energy content, which is supporting market expansion.

Impact of Covid-19 on the industry

The COVID-19 pandemic has significantly changed the condition of the industrial and chemical sectors, which has impeded the expansion of the term-butanol market. The situation has worsened as a result of the implementation of steps to stop the spread of SARS-CoV-2. The performance of the flavours and fragrances, paints and coatings, and medicines industries, among others, has been impeded by the abrupt distortion in operational efficiencies and disruptions in value chains caused by the abrupt shutdown of national and international boundaries. Additionally, the pandemic caused cancellations, order backlogs, and discontinuations in product orders and deliveries. The demand for tert-butanol has decreased as a result of the notable slowdown in the expansion of various industries.

Market Drivers

Government Initiatives Bolstering the Growth of the Building & Construction Sector

Buildings frequently use butanol-based paints, varnishes, rubbers, and polymers for things like windows, walls, doors, floors, and more. The governments in the Asia-Pacific area are taking steps to increase building and construction activities. To enhance space for international flights at the nation's No. 2 hub, Kansai International Airport in Japan will invest nearly 100 billion yen (US$911 million) by 2025 in an overhaul of the larger terminal. The Indian Union Budget of February 2020 aims to construct 100 new airports by 2024 as part of the Udan project of the Center, which was created to help with the increasing aviation traffic.

The Pradhan Mantri Awas Yojana (PMAY) program, an initiative of the Indian government, intends to offer affordable housing to all urban poor people by the year 2022 through financial support. Such government initiatives are anticipated to boost demand for paints, coatings, rubbers, and polymers in the Asia-Pacific building and construction sector and further fuel the expansion of the butanol market over the anticipated period.

Bolstering the Growth of the Personal Care and Food & Beverage Sector will drive the market growth

Butanol is frequently used as a solvent in pharmaceuticals and as a flavouring agent in foods in the personal care, cosmetics, and food and beverage industries. The personal care, cosmetics, and food and beverage industries are flourishing in Asia-Pacific nations as a result of rising consumer demand and rising per-capita income. For instance, the beauty, cosmetics, and grooming sector in India will increase from US$6.5 billion to US$20 billion by 2025, predicts the India Brand Equity Foundation (IBEF). The International Trade Administration estimates that Thailand's market for cosmetics and personal care products was worth about US$6.2 billion in 2018 and will increase to US$8.0 billion by 2022.

From 2019 to 2022, the beauty and personal care industry in Thailand is anticipated to expand at a rate of 7.3% annually. The China Chain Store & Franchise Association reports that China's food and beverage (F&B) industry generated $595 billion in revenue in 2019, an increase of 7.8% over the previous year. The United States Department of Agriculture (USDA) estimates that Japan's retail food and beverage (F&B) sales reached US$474.13 billion in 2020, an increase of 1.5% from US$466.97 billion in sales in 2019. The Asia-Pacific region's burgeoning personal care and cosmetics and food and beverage industries have resulted in a major rise in butanol consumption. Consequently, the expanding industries of food and beverage and personal care and cosmetics serve as a catalyst for the butanol market during the forecast period.

Market Restraints

Volatile raw material prices will challenge the market growth

The market's expansion will be hampered by several obstacles and hurdles. It is predicted that factors including raw material price volatility and the shortage will slow growth during the forecast period. Additionally, n-butanol environmental constraints are restricting market expansion. Additionally, declining Dop (Bis (2-Ethylhexyl) Phthalate) consumption in North America and Europe as well as low economies of scale for small capacity plants are potential obstacles to the overall expansion of the worldwide N-Butanol industry.

ASIA-PACIFIC BUTANOL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Type, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Eastman Chemical Company, Mitsubishi Chemical Corporation, Dow, SABIC, Galaxy Chemicals, KH Chemicals, Solventis, KH Neochem Co., Ltd., OQ Chemicals GmbH, China National Petroleum Corporation (CNPC) |

This research report on the Asia-pacific butanol market has been segmented and sub-segmented based on, type, end-user, and Geography & region.

Asia-Pacific Butanol Market- By Type

-

N-butanol

-

2-butanol

-

Iso-butanol

-

Tert-butanol

The N-Butanol category, which accounted for 84% of the Asia-Pacific Butanol market in 2021, is anticipated to expand at a CAGR of 5.3% from 2023 - 2030. N-butanol sometimes referred to as 1 butanol or butyl alcohol, is an alcoholic beverage produced from corn sugars through fermentation or petrochemical methods. Because it has greater energy, is more compatible with the structure of gasoline, doesn't absorb water from the environment, and is non-corrosive, n-butanol is a better fuel substitute than ethanol. In recent years, scientists have begun investigating n-butanol as a biofuel substitute for bioethanol.

Straight-chain alcohol (n-butanol), which has numerous advantages over ethanol, including a larger energy content, decreased volatility, and a reduced propensity to absorb moisture, is regarded as the next generation of biofuels. Butanol has twice as many carbon atoms as ethanol, which is a benefit. In contrast to other types of butanol, as a result, the demand for n-butanol is significantly rising, which is significantly propelling the expansion of the n-butanol market.

Asia-Pacific Butanol Market- By End-User

-

Paints & Coating

-

Chemical & Petrochemical

-

Textile

-

Agriculture

-

Building & Construction

-

Food & Beverages

-

Transportation

-

Pharmaceuticals

-

Others

The transportation sector, which accounted for a sizeable portion of the Asia-Pacific Butanol market in 2021, is anticipated to expand at a CAGR of 5.8% from 2023 - 2030. The production of bio-fuels and paints, which are then extensively employed in the transportation industry in cars, planes, ships, and trains, frequently uses butanol as an intermediary. Because biofuel is biodegradable, non-toxic, and creates fewer pollutants when entirely burned, customers are choosing butanol-based biofuels over ethanol and methanol-based ones.

In several Asia-Pacific nations, the transportation sector is booming. For instance, the Indian automobile market is anticipated to reach Rs. 16.16-18.18 trillion (US$ 251.4-282.8 billion) by 2026, according to the India Brand Equity Foundation (IBEF). According to information from the Ministry of Industry and Information Technology, the Chinese ship industry completed the building of ships totalling over 20.92 million deadweight tonnes (dwt) between January and June 2021, an increase of 19% over the previous year. This is directly assisting the transportation sector's expansion in the Asia-Pacific butanol market.

Asia-Pacific Butanol Market- By Region

-

China

-

Japan

-

Australia

-

India

-

Indonesia

-

Taiwan

-

South Korea

-

Malaysia

-

Rest of APAC

China, which in 2021 had the greatest market share in the Asia-Pacific Butanol region, is anticipated to expand at a CAGR of 5.8% from 2023 - 2030 as a result of the country's booming transportation industry. The Chinese transportation sector is expanding; as an example, Boeing predicted that over the next 20 years, Chinese airlines would spend US$1.4 trillion on 8,600 new planes and US$1.7 trillion on commercial aircraft services. China continues to be the world's largest automobile market by yearly sales and manufacturing output, according to the International Trade Administration (ITA), with domestic production anticipated to exceed 35 million vehicles by 2025. The shipbuilding sector in China experienced rapid growth in the first half of 2021.

According to information from the Ministry of Industry and Information Technology, the industry completed the building of ships totalling over 20.92 million deadweight tonnes (dwt) from January to June, up 19% from the previous year. Shipbuilders in the nation received 38.24 million dwt in new orders, up 206.8% from a year earlier. Shipbuilding orders in China reached 86.6 million dwt by the end of June 2021, an increase of 13.1% from the previous year. Additionally, China's demand for biofuels and paints is rising rapidly along with vehicle manufacturing, which is boosting demand for the Asia-Pacific butanol sector in China throughout the course of the projection period.

Asia-Pacific Butanol Market- By Companies

-

Eastman Chemical Company

-

Mitsubishi Chemical Corporation

-

Dow

-

SABIC

-

Galaxy Chemicals

-

KH Chemicals

-

Solventis

-

KH Neochem Co., Ltd.

-

OQ Chemicals GmbH

-

China National Petroleum Corporation (CNPC)

NOTABLE HAPPENINGS IN THE AISIA-PACIFIC BUTANOL STORAGE MARKET IN THE RECENT PAST:

-

Research & Development: - In 2021, The electrochemical reduction reaction (CO2RR) and copper phosphide (CuP2) were used by a team of scientists from South Korea's Gwangju Institute of Science and Technology to create 1-Butanol directly from CO2 without the need for CO dimerization.

-

Government Investment: - In 2021, A memorandum of understanding (MoU) for the execution of the LuPech project, the N-Butanol project, and other infrastructure projects at the Gujarat refinery was signed by the government of Gujarat and IOC.

-

Business Collaboration: - In 2020, LP OxoSM SELECTORTM 10 Technology has been chosen by the Chinese company Guangxi Huayi New Material Company Ltd. (Huayi) to generate butanol at a new manufacturing facility, according to a joint announcement by Dow and Johnson Matthey (JM). According to this licence, a plant with a 300,000 metric tonne per year butanol capacity will be constructed at Huayi's integrated petrochemical complex in Qinzhou Port, P.R. China.

Chapter 1. Asia-Pacific Butanol Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific Butanol Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Asia-Pacific Butanol Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Asia-Pacific Butanol Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Asia-Pacific Butanol Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Butanol Market – By Type

6.1. N-butanol

6.2. 2-butanol

6.3. Iso-butanol

6.4. Tert-butanol

Chapter 7. Asia-Pacific Butanol Market – By End-User

7.1. Paints & Coating

7.2. Chemical & Petrochemical

7.3. Textile

7.4. Agriculture

7.5. Building & Construction

7.6. Food & Beverages

7.7. Transportation

7.8. Pharmaceuticals

7.9. Others

Chapter 8. Asia-Pacific Butanol Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Asia-Pacific Butanol Market – key players

9.1 Eastman Chemical Company

9.2 Mitsubishi Chemical Corporation

9.3 Dow

9.4 SABIC

9.5 Galaxy Chemicals

9.6 KH Chemicals

9.7 Solventis

9.8 KH Neochem Co., Ltd.

9.9 OQ Chemicals GmbH

9.10 China National Petroleum Corporation (CNPC)

Download Sample

Choose License Type

2500

3400

3900

4600