Agricultural Biotechnology Market Size (2023– 2030)

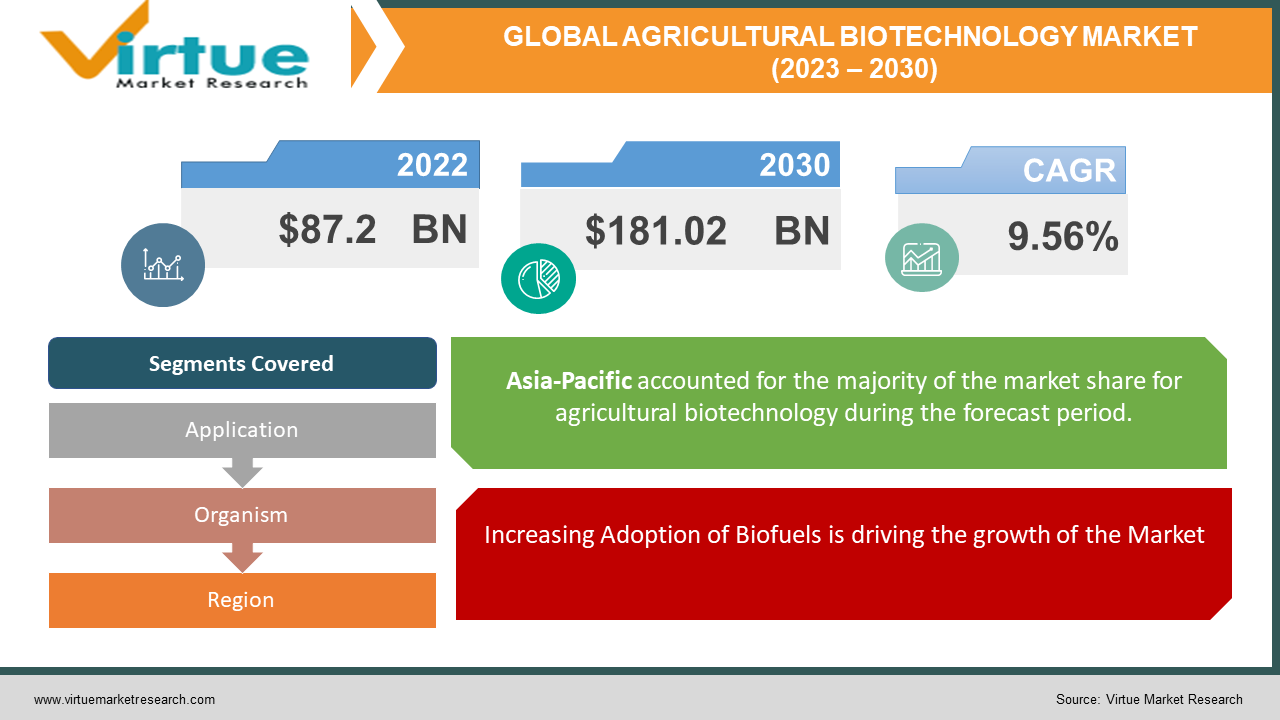

As per our research report, the global Agricultural Biotechnology Market size was USD 87.2 billion in 2022 and is estimated to grow to USD 181.02 billion by 2030. This market is witnessing a healthy CAGR of 9.56% from 2023 - 2030. The growing rate of production of fruits and vegetables especially in the developing economies such as China and India, increasing focus on the latest trends in the market, growing application of advanced and modern agricultural and farming practices, high growth in emerging countries coupled with high adoption of innovative technologies, and increasing industry competitiveness are majorly driving the growth of the industry.

Industry Overview:

Biotech tools are increasingly in demand in agricultural applications. These include tissue culture and micropropagation, marker-assisted breeding or molecular propagation, transgenic crops and genetic engineering, molecular diagnostic technology, and conventional plant breeding. The increase in the adoption of genetically modified (GM) crops globally is anticipated to drive the market throughout the forecast period. Indeed, genetic modification enables the production of forage and food crops with improved properties such as high nutritional value, high yield, improved food processing quality, and disease resistance. In many countries, GM crops have been rapidly adopted, and the market for GM seeds that are resistant to insects and herbicides is one of the growing sectors of the agricultural sector. According to the International Service for the Acquisition of Agricultural Technology Applications (ISAAA) estimates, 2.15 billion hectares of biotech crops were grown commercially between 1996 and 2016. This includes 0.34 billion hectares of biotech cotton, 1.04 billion hectares of biotech soybeans, 0.13 billion hectares of biotech rapeseed, and 0.64 billion hectares of biotech corn. These products contribute a significant portion of the world's consumption of fiber, feed, fuel, and food.

The increase in production and propagation of GM crops worldwide due to increasing food demand and increasing world population is another important factor that is increasing the demand and application of biotechnology. In addition, the increasing application of biotechnology in the cultivation of these crops to increase production value in terms of size, color, or yield by altering their characteristics will create opportunities for bigger. The expansion and growth of the agricultural business, particularly in developing economies, has fueled an increase in demand for agricultural biotechnology applications. The agricultural industry is profiting from increased penetration of biotechnology, tissue culture, and molecular breeding in the realm of agriculture.

COVID-19 impact on Agricultural Biotechnology Market

COVID19 is an unprecedented global public health emergency that has affected virtually every industry and the long-term effects are estimated to impact industry growth over the forecast period. Our ongoing research amplifies our research framework to ensure it covers the basics of COVID19 and potential pathways forward. The report provides COVID19 insights looking at shifts in consumer behavior and needs, shopping patterns, supply chain rerouting, current market dynamics, and key interventions government.

We continuously monitor and update reports on the political and economic turmoil caused by Russia's invasion of Ukraine. Negative effects are widely anticipated globally, particularly in Eastern Europe, the European Union, East and Central Asia, and the United States. This controversy has severely affected lives and livelihoods and represents a profound disruption to business dynamics. The potential effects of the ongoing war and instability in Eastern Europe are expected to hurt the global economy, especially with harsh long-term effects on Russia.

MARKET DRIVERS:

Increasing Adoption of Biofuels is driving the growth of the Market

Biofuel sources mainly include crops such as wheat, corn, soybeans, and sugar cane, but organic waste can also be used as a potential source. The growing global demand for biofuels is because biofuels burn cleaner than traditional fossil fuels and emit fewer pollutants and greenhouse gases into the atmosphere. Therefore, in developed countries in Europe and the United States, the adoption of fuel-efficient biofuels, which are mainly produced using biotechnology, is progressing. Therefore, increasing biofuel adoption is an important trend in the agricultural biotechnology market.

Increasing Demand for Food Products is also driving the growth of the Market

Population growth leads to increased demand for food and the consequent dependence on agricultural biotechnology. According to the United Nations Bureau of Economy and Society, the world's population has increased from 6.9 billion in 2010 to 7.7 billion in 2019. In addition, half of the world's population growth is estimated to increase between 2015 and 2050, concentrating in 10 countries: Nigeria, China, India, the Democratic Republic of the Congo, Pakistan, Ethiopia, the United States, Tanzania, Indonesia, and Uganda. The growing population will need adequate food supplies to sustain it, which in turn will facilitate the adoption of advanced biotechnology tools in agriculture, thereby supporting the growth of the agricultural biotechnology market.

MARKET RESTRAINTS:

Initial High Investment and Shortage of Skilled person is restraining the growth of the Market

Biotechnology is a new technology that requires a high amount of initial investments which restrains the growth of the market. Also, there is a high demand for skilled people and a lack of knowledge among them on how to use the technology efficiently creates a sense of confusion among the person in charge. Which further restrains the growth of the market.

Agricultural Biotechnology Market Report Coverage:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9.56% |

|

Segments Covered |

By Application, Organism and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

KWS SAAT SE & Co. KGaA, ChemChina, Limagrain, Nufarm, Marrone Bio Innovations, Performance Plants Inc., Corteva, ADAMA Ltd, MITSUI & CO., LTD, Evogene Ltd., Valent BioSciences LLC, and Bayer AG |

This research report on the Agricultural Biotechnology Market has been segmented and sub-segmented based on Organism type, application, and region.

Agricultural Biotechnology Market - By Application:

- Vaccine Development

- Transgenic Crops & Animals

- Antibiotic Development

- Nutritional Supplements

- Flower Culturing

- Biofuels

Based on application, the agricultural biotechnology market is segmented into six segments based on applications, namely vaccine development, transgenic crops and livestock, antibiotic development, nutritional supplements, floriculture, and biofuels. The transgenic crops and livestock segment generated the highest revenue in 2021, while vaccine development is estimated to grow the fastest compared to other applications.

Agricultural biotechnology has helped in livestock as well as crop improvement by incorporating advanced tools. Integrated agricultural biotechnology is widely applied in tissue culture, micropropagation, embryo transfer, cloning, artificial insemination, etc. Biotechnological tools have been successfully applied in the micropropagation of disease-free plants, improving aluminum tolerance, enriching crops, and genetically modifying crops.

Agricultural Biotechnology Market - By Organism Type:

- Plants

- Animals

- Microbes

Based on the Organism type, Agricultural biotechnology involves the use of a range of modern techniques to develop innovative products with improved quality characteristics. Conventional breeding techniques have largely been applied to plant and animal genome modifications. In addition, advances in genetic engineering have made it possible to control the changes that genes cause in the body.

Advanced biotechnology tools have enabled experts to incorporate new genes from one species into another, to optimize agricultural production or the production of pharmaceutical compounds valuable. The most common topics of genetic engineering include farm animals, crops, and soil bacteria. The global agricultural biotechnology market is categorized into three segments based on the organism: plant, animal, and microorganism.

Agricultural Biotechnology Market - By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East

- Africa

Geographically, North America dominated with the largest share of revenue in 2021, due to the wide range of agricultural and crop regions, as well as the large global area planted with genetically modified (GM) crops. In this region, the United States and Canada together account for about 50% of the global GM area and about 10% of the global planted area. Major crops grown in about 70% of North America's arable area include corn, soybeans, and wheat, followed by alfalfa, cotton, canola, and barley. In addition, North America is a net exporter of agricultural products with about 30% of corn, soybeans, and wheat produced worldwide.

While Asia-Pacific is forecast to grow at the fastest rate during the forecast period. The region is characterized by the presence of several different political and economic systems, and cultural and linguistic origins. In it, the agricultural industry changed from adopting high technical standards in Japan to basic systems in India.

Asia - Pacific is a lucrative market as this region accounts for nearly 40% of the world's cultivated area (nearly 600 million hectares). The region is also characterized by the importance of rice farming (except for Australia) and the predominance of smallholder farmers. Rice is supplied at large subsidies throughout Asia, and food security is a major concern for local governments in most developing economies. The region accounts for nearly 90% of the total rice-growing area, with 20% and 28% in China and India respectively.

Agricultural Biotechnology Market Share by company

-

KWS SAAT SE & Co.

-

KGaA,

-

ChemChina

-

Limagrain

-

Nufarm

-

Marrone Bio Innovations

-

Performance Plants Inc.,

-

Corteva

-

ADAMA Ltd

-

MITSUI & CO., LTD

-

Evogene Ltd.

-

Valent BioSciences LLC

-

Bayer AG

Recently KWS SAAT SE & Co. KGaA has launched six new hybrid maize varieties under its brands, KWS and Riber, in Brazil. These varieties offer high genetic protection against insects, high yields, and tolerance to herbicides. This launch has enabled the company to offer an innovative seed portfolio to Brazilian farmers, strengthening their presence in Brazil.

Syngenta AG announces the acquisition of Sensako (Pty) Ltd., a South African seed company specializing in cereals. Syngenta's entry into the South African wheat, maize, and sunflower seed markets will be facilitated by this acquisition, which will lay the groundwork for future expansion.

Suppliers invest in research and development to create technologically improved systems that provide them a competitive advantage over competitors and benefit the industry economically. Over the next few years, the industry is projected to see a number of mergers and acquisitions. Corporations are taking proactive steps to gain market share and provide a expanded product portfolio.

NOTABLE HAPPENINGS IN THE AGRICULTURAL BIOTECHNOLOGY MARKET IN THE RECENT PAST:

Product Launch - ADAMA Agricultural Solutions Ltd. released a novel prothioconazole fungicide in February 2021 that delivers enhanced disease management for cereal and oilseed rape disease (OSR).

Acquisition - Syngenta AG announced the acquisition of Sensako (Pty) Ltd., a South African cereal seed producer, in April 2020. Syngenta's foray into the South African wheat, corn, and sunflower seed industries will be aided by this acquisition, which will pave the way for future growth.

Chapter 1. Agricultural Biotechnology Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Agricultural Biotechnology Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Agricultural Biotechnology Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Agricultural Biotechnology Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Agricultural Biotechnology Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Agricultural Biotechnology Market – By Organism Type

6.1. Plants

6.2. Animals

6.3. Microbes

Chapter 7. Agricultural Biotechnology Market – By Application

7.1. Vaccine Development

7.2. Transgenic Crops & Animals

7.3. Antibiotic Development

7.4. Nutritional Supplements

7.5. Flower Culturing

7.6. Biofuels

Chapter 8. Agricultural Biotechnology Market - By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Agricultural Biotechnology Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. KWS SAAT SE & Co.

9.2. KGaA,

9.3. ChemChina

9.4. Limagrain

9.5. Nufarm

9.6. Marrone Bio Innovations

9.7. Performance Plants Inc.,

9.8. Corteva

9.9. ADAMA Ltd

9.10. MITSUI & CO., LTD

9.11. Evogene Ltd.

9.12. Valent BioSciences LLC

9.13. Bayer AG

Download Sample

Choose License Type

2500

4250

5250

6900