Global Aerospace and Defense Additive Manufacturing Market Size (2023-2030)

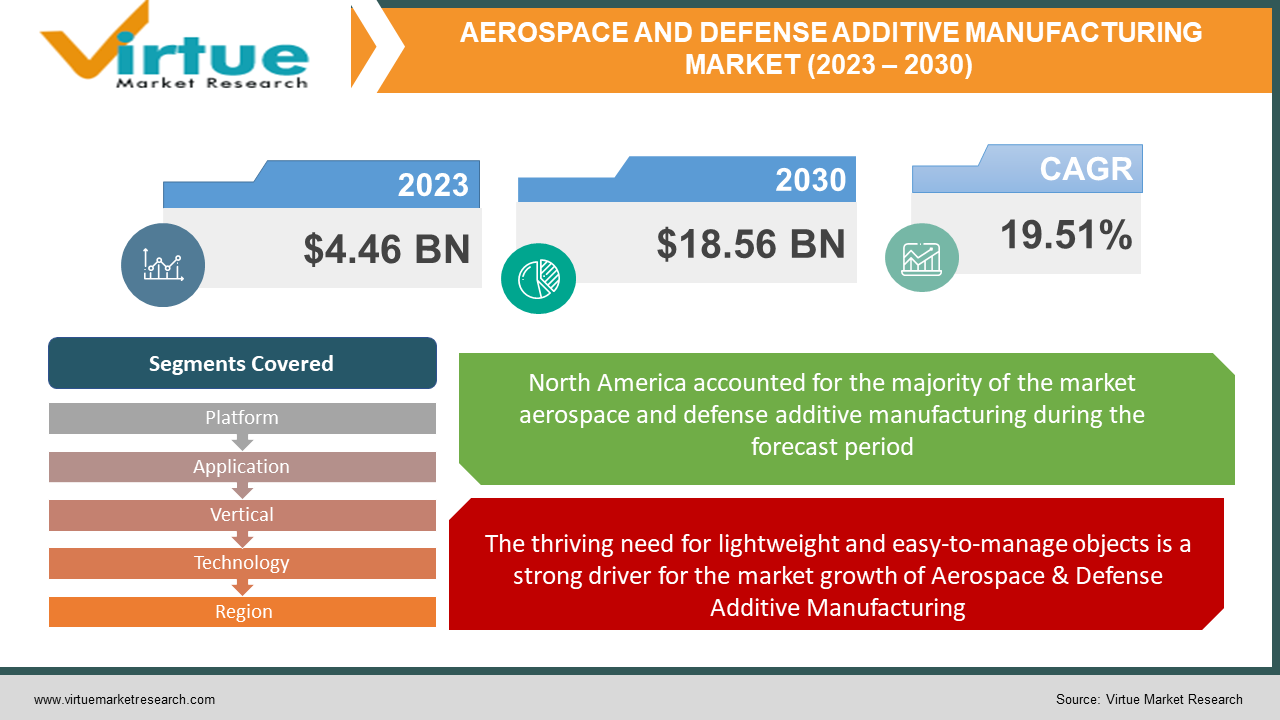

The Global Aerospace & Defense Additive Manufacturing Market was valued at USD 4.46 Billion and is projected to reach a market size of USD 18.56 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 19.51%.

The increasing demand for additive manufacturing in all sectors and the thriving need for lightweight easy-to-manage objects are the primary drivers which aid in the flourishing growth of the Aerospace & Defense Additive Manufacturing Market.

Industry Overview:

Additive manufacturing is an industry that is fairly new but it has been flourishing at a massive rate. It is in some ways synonymous with 3D printing. 3D printing of a product can be both fragile or durable depending upon the specific case and the material used. Additive manufacturing is a sub-category of 3D printing in which case the objects created are extremely durable but they retain the property of being lightweight objects. It is a great substitute for using heavy metals and elements to construct objects that may weigh down everything around it. Some parts and machinery of space aircraft and defense machinery need not be heavy duty. The lighter substitute of such products is much more preferable and makes it easier to use and handle. Especially in the case of the defense industry, several weapons, armories, and vehicles are extremely loaded and difficult to carry across the battlefield. Manufacturing some parts with the help of additive manufacturing helps lessen the load. Several new-age space aircraft use additive manufacturing for hundreds of their sub-parts making them easy to carry through outer space.

COVID-19 impact on the Aerospace and Defense Additive Manufacturing Market:

The COVID-19 pandemic hit the entire globe rapidly from the city of Wuhan in China. What was considered to be flu and cold took the world over by storm and has been capable of uprooting several industries altogether. The pandemic brought with itself several restrictions where entire nations shut their borders down so that people could not travel internationally. Most countries managed to shut down internal borders as well leading to a complete lockdown such that internal migration within the same nation also became impossible. This affected the Aerospace & Defense Additive Manufacturing market very intensely as well. The manufacturing of space aircraft and defense equipment was not observed to be a priority or an essential industry. Thus the market took a major financial hit. Though the industry has recovered almost all the losses it suffered after the pandemic, COVID-19 had a staggering effect on it for the entirety of its duration.

Market Drivers:

The thriving need for lightweight and easy-to-manage objects is a strong driver for the market growth of Aerospace & Defense Additive Manufacturing:

Whenever any object is made with the help of additive manufacturing it is extremely lightweight and can be used in any and all aspects required. In the aerospace industry to be specific, the aircraft manufactured are used in multiple different fields. Whenever an aircraft is to be sent to outer space the most essential part is ensuring that it is as lightweight as possible. A heavy aircraft will not be able to launch itself into external orbit let alone travel outer space for extended periods of time. Thus it is extremely significant to cut back on weight wherever possible and make as many parts as light as one can. Additive manufacturing has therefore been a boon for the aerospace industry. On the other hand, the defense industry requires spry movement through the battlefield, whether it be on solid land or other surfaces. Thus lightweight and easy-to-manage parts are a must in both cases and their dire need helps to propel the market forward.

The increasing demand for additive manufacturing across all sectors is a potent driver that leads to the growth of the market:

Most machinery across all sectors is aimed more and more towards being lightweight and easy to move around. This has increased the need for additive manufacturing. In recent cases, it was also observed that a significant portion of the new A350 XWB aircraft was made with additive manufacturing and 3D-printed parts. This ensures that the metals and other materials are cut back on their use and that the overall manufactured object is lightweight. A lot of industries are aiming to adopt this approach to cut back on the use of other raw materials and to make their product on par with the competition.

Market Restraints:

The Aerospace and Defense Additive Manufacturing Market's growth is being stifled by the high costs of manufacturing machinery and final product.

Additive manufacturing is a fairly new industry that is yet to observe several innovations. It is not as saturated as several other industries. Because of this, the materials required for production are very expensive. The raw materials that are fed into the machinery are costly and using them for mass production is not viable. The machine itself, which undergoes manufacturing, is difficult to procure and very expensive. Thus, the overall cost of manufacturing a single product skyrockets and becomes almost impossible to use it for mass production. This challenge is a major factor in hindering the growth of the market to its full potential.

AEROSPACE & DEFENSE ADDITIVE MANUFACTURING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

19.51% |

|

Segments Covered |

By Platform, Application, Vertical, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

EOS , ProdWays TECH , 3D Systems, Inc. , EnvisionTEC, Stratasys Ltd. , Ultimaker BV , Renishaw plc. , ExOne , Optomec, Inc. , SLM Solutions |

Market Segments:

This research report on the global Aerospace and Defense Additive Manufacturing Market has been segmented based on Platform, Vertical, Application, Technology, and Region.

Aerospace and Defense Additive Manufacturing Market- By Platform

- Aviation

- Aircraft

- UAV

- Defense

- Combat Vehicles

- Military PPE

- Weapons

- Submarine Hulls

- Others

- Space

- Engines

- Satellites

- Spacecraft

- Rockets

The aviation segment has shown the maximum growth and has held the maximum market share in the past due to rising investments in the sector. But the space sector is anticipated to grow at a flourishing rate and dominate the forecast period of 2022-2030. Several space inventions and missions to explore further galaxies can contribute to the growing market share of this segment.

Aerospace and Defense Additive Manufacturing Market- By Vertical

- Printer

- Material

- Others

The initial advancements that were done, were carried out in several kinds of 3D printers for all uses be they commercial, professional, or otherwise. Thus the printers sub-segment held the largest market share in the past. In recent times, additive manufacturing is being done with several materials and experimentation is being done daily to use new materials to 3D print. Therefore in the forecasted period, materials will show the most growth.

Aerospace and Defense Additive Manufacturing Market- By Application

- Engine Components

- Space Components

- Structural Components

- Defense Equipment

- Others

During the forecast period, 2023–2030, the engine component is estimated to increase at the fastest rate. On the other hand, the space components sector dominated the market in the previous years, owing to the rise in several space explorations and government contributions to the market.

Aerospace and Defense Additive Manufacturing Market- By Technology

- Fused Deposition Modeling (FDM)

- Direct Metal Laser Sintering (DMLS)

- Stereolithography (SLA)

- Continuous Liquid Interface Production (CLIP)

- Selective Laser Sintering (SLS)

- Others

Due to its durability and tenacity the Fused Deposition Modelling (FDM) segment held the majority of the market share where the technology segment was considered. In the forecasted period of 2022-2030, the Direct Metal Laser Sintering or DMLS sub-segment is predicted to grow at a fast pace because it produces products that have all the long-lasting properties that a market desires.

Aerospace and Defense Additive Manufacturing Market- By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

The biggest market for Aerospace and Defense Additive Manufacturing is North America. It has one of the biggest military budgets in the world and also has a significantly developed space industry. But due to the rise of defense budgets of several countries like India and China and developments in the space sector Asia-Pacific is estimated to become the biggest market shareholder in the forecasted period.

Major Key Players in the Market

- EOS

- ProdWays TECH

- 3D Systems, Inc.

- EnvisionTEC

- Stratasys Ltd.

- Ultimaker BV

- Renishaw plc.

- ExOne

- Optomec, Inc.

- SLM Solutions

Market Insights and Developments

- In November 2022, at the German Formnext expo, the company Stratasys depicted a visual of a completely unattended additive manufacturing process. It was guided by robots and an entire manufacturing line ran without human presence.

- In January 2022, a company called Nanoscribe released a Quantum X align additive manufacturer or a 3D printer that could easily print desired things onto optical fibres and chips that are photonic.

Chapter 1. AEROSPACE AND DEFENSE ADDITIVE MANUFACTURING MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. AEROSPACE AND DEFENSE ADDITIVE MANUFACTURING MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. AEROSPACE AND DEFENSE ADDITIVE MANUFACTURING MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. AEROSPACE AND DEFENSE ADDITIVE MANUFACTURING MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. AEROSPACE AND DEFENSE ADDITIVE MANUFACTURING MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. AEROSPACE AND DEFENSE ADDITIVE MANUFACTURING MARKET – By Platform

6.1. Aviation

6.1.1.Aircraft

6.1.2. UAV

6.2. Defense

6.2.1. Combat Vehicles

6.2.2. Military PPE

6.2.3. Weapons

6.2.4. Submarine Hulls

6.2.5. Others

6.3. Space

6.3.1. Engines

6.3.2. Satellites

6.3.3. Spacecraft

6.3.3.1. Rockets

Chapter 7. AEROSPACE AND DEFENSE ADDITIVE MANUFACTURING MARKET – By Vertical

7.1. Printer

7.2. Material

7.3. Others

Chapter 8. AEROSPACE AND DEFENSE ADDITIVE MANUFACTURING MARKET – By Technology

8.1. Fused Deposition Modeling (FDM)

8.2. Direct Metal Laser Sintering (DMLS)

8.3. Stereolithography (SLA)

8.4. Continuous Liquid Interface Production (CLIP)

8.5. Selective Laser Sintering (SLS)

8.6. Others

Chapter 9. AEROSPACE AND DEFENSE ADDITIVE MANUFACTURING MARKET – By Application

9.1. Engine Components

9.2. Space Components

9.3. Structural Components

9.4. Defense Equipment

9.5. Others

Chapter 10. AEROSPACE AND DEFENSE ADDITIVE MANUFACTURING MARKET – By Region

10.1. North America

10.2. Europe

10.3.The Asia Pacific

10.4.Latin America

10.5. Middle-East and Africa

Chapter 11. AEROSPACE AND DEFENSE ADDITIVE MANUFACTURING MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. EOS

11.2. ProdWays TECH

11.3. 3D Systems, Inc.

11.4. EnvisionTEC

11.5. Stratasys Ltd.

11.6. Ultimaker BV

11.7. Renishaw plc.

11.8. ExOne

11.9. Optomec, Inc.

11.10. SLM Solutions

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Aerospace and Defense Additive Manufacturing Market is estimated to be worth USD 4.46 Billion in 2022 and is projected to reach a value of USD 18.56 Billion by 2030, growing at a CAGR of 19.51% during the forecast period 2023-2030.

The increasing demand for additive manufacturing in all sectors and the thriving need for lightweight easy-to-manage objects are the primary drivers which aid in the flourishing growth of the Aerospace and Defense Additive Manufacturing Market.

The Aerospace and Defense Additive Manufacturing Market's growth is being stifled by the high costs of manufacturing machinery and final product.

EOS, ProdWays TECH, 3D Systems, Inc., EnvisionTEC, Stratasys Ltd are some of the major players in the Aerospace and Defense Additive Manufacturing market.

The Aerospace and Defense Additive Manufacturing Market by technology is segmented into FDM, DMLS, SLA, CLIP, SLS, and Others.