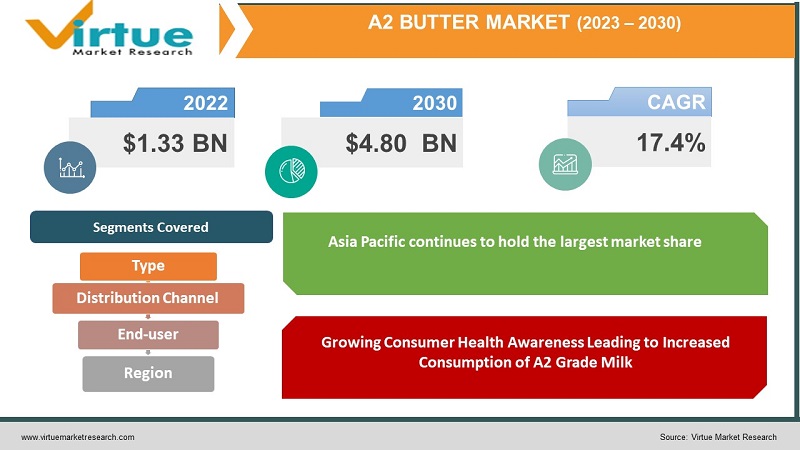

A2 Butter Market Size (2022 – 2030)

In 2022, the Global A2 Butter Market was valued at USD 1.33 billion and is projected to reach a market size of USD 4.80 billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 17.4%.

INDUSTRY OVERVIEW

One of the foods that people utilize daily is milk. In addition to milk, goods made from milk, including butter, paneer, or curd, are also widely consumed. If we consider our daily use of milk and milk products, we must utilize high-quality goods. Many companies that sell milk products use milk from A1 crossbred cows. However, switching to A2 milk and other related products might undoubtedly be good for health. A1 -casein proteins are absent in A2 milk, a subtype of cow's milk. The ingestion of A2 butter is known to avoid the symptoms of stomach discomfort, such as gas, bloating, and diarrhea, which often appears after ingesting dairy products in lactose-intolerant persons. In addition, it is a rich source of omega-3 fatty acids, which support the body's growth and development. The global market has grown recently as a result of rising income levels and increased knowledge of the nutritional advantages of A2 butter.

The milk we often use, however, is A1 milk from foreign cross-breed cows, which we are completely oblivious of when it comes to milk. The milk changes as a result of extensive cross-breeding done for profit. Utilizing such milk may cause internal inflammation, lactose intolerance, IBS, and bloating. Contrarily, A2 Desi Cow Milk and related products like butter and yoghurt are made from Indian breeds like Gir cows, as the name implies. A2 beta-casein is present in goods made from Desi cow milk, but A1 dairy products also include A2 beta-casein. A2 butter is widely recommended by nutritionists since it supports a healthy lifestyle. Steroids, which are frequently used to increase milk production, are absent from A2 milk products.

Nutritionists emphasize that consuming products made from A2 Desi cow milk improves digestion and immunity. Possible causes of all those stomach aches include consuming low-quality dairy products regularly. You may avoid these inflammations by substituting them with high-quality A2 milk products because they are a rich source of protein and contain solely A2 proteins. It implies that goods made with A2 Desi cow milk will cause less gastrointestinal pain than milk will. Making the switch to A2 milk products will be an effective way to speed up your metabolism, prevent lactose intolerance, and promote bone and muscle building. The taste of food will be enhanced and meals will have richer tastes if A2 Desi cow milk products are used. However, the main difficulties that the producers confront are the high costs of A2 milk and the availability of cheaper and vegan replacements. Additionally, the market's expansion may be hampered by the absence of enough scientific proof of the advantages of A2 milk and other A2 milk-related products.

COVID-19 IMPACT ON THE A2 BUTTER MARKET

COVID-19 started in Wuhan (China) in December 2019 and has since quickly expanded around the world. In terms of confirmed cases and reported deaths, the US, India, Brazil, Russia, France, the UK, Turkey, Italy, and Spain are among the nations that have been most severely impacted. Due to lockdowns, travel bans, and company closures, COVID-19 has had an impact on the economies and businesses, including the food and beverage industry, in many different nations. On the first days of the pandemic, there was an increase in demand for A2 milk and its related products at retail establishments, which was brought on by consumers' panic buying. Due to the stocking of products through the reseller channel as well as online sales, the A2 Milk Company, one of the key players in the A2 butter industry, has seen a growth in its sales, particularly in China and Australia. Due to the lockdown's extension in some nations, the demand for A2 milk and its related products declined. However, due to worldwide vaccination drive and growing health consciousness among consumers is likely to positively influence the market development.

MARKET DRIVERS:

Growing Consumer Health Awareness Leading to Increased Consumption of A2 Grade Milk

Consumption of wholesome foods is becoming more popular among customers everywhere. Milk, butter and yoghurt are a few examples of dairy products that are among the foods that are consumed the most globally. Milk is widely consumed since it is regarded as a nutritious and healthful food. However, a growing number of people are finding they cannot drink milk or milk products because of lactose sensitivity or other medical issues. Because these goods are readily available, persons with lactose sensitivity can consume them without experiencing any difficulty. One such product is A2-grade milk products. Furthermore, A2-grade products milk has high levels of calcium, proteins, vitamins, and minerals. Additionally, the protein structure of A2 butter is more comparable to that of human breast milk than it is to that of goat, sheep, or buffalo milk.

Growing demand for processed food products to drive market growth

The demand for dairy products has been changing worldwide away from vegetable oil-based alternatives to dairy fats. This tendency is attributable to the evolution of taste as well as the favorable health impression of dairy fat. It is projected that more dairy products would be consumed in emerging nations due to an increase in processed food consumption as consumer discretionary income rises and diets become more globally diversified. The increased demand for bakery goods including cakes, bread, cookies, and biscuits is a major factor in the bakery industry's increased use of butter. It is a component that must be used in the production of confections. It is anticipated that demand for butter will rise as different confectionary products become more and more popular. It has a wide range of uses in convenience foods, particularly in ready-to-eat and ready-to-cook meals, which are hugely successful right now. It is anticipated that in the next years, the use of butter will expand as a result of growing innovations and advancements in dairy beverages.

The rising popularity of butter across retail & food service sectors to further fuel market growth

One of the items that sell the quickest in retail channels is packaged butter. During the epidemic and countrywide lockdowns, a lot of customers started baking and cooking at home. The demand for its retail packaging in both established and developing markets was greatly raised by these considerations. Premium grade has grown in favor among customers in industrialized nations in recent years. Organic, clean-label, and butter made from A2 milk are an example of premium butter. Consumer demand for A2 butter is also anticipated to rise as discretionary income levels rise. Around the world, butter is a common element in hotels, restaurants, cafés, and caterers. Its use in diverse cuisines that are served freshly in cafes and restaurants has expanded as a result of consumers' changing tastes. In the upcoming years, market development is predicted to be driven by the newly popular habit of eating out and buying convenience foods.

MARKET RESTRAINTS:

Growing demand for lactose-free and plant-based meals will restrain market expansion

Due to growing public concern over animal cruelty, there is an increase in the demand for plant-based diets. Additionally, the market for popular retail items is quickly turning toward plant-based foods and beverages. The demand for natural butter substitutes like soymilk and nut milk-based butter is on the rise due to the growing belief that plant-based goods are safer and healthier. The demand for dairy substitutes is also rising as more people develop lactose sensitivity. Products that include lactose are regarded as harmful since they help to cause obesity and illnesses linked to lifestyle. The rapidly expanding dairy alternatives market, which has introduced new goods including non-dairy ice cream, bakeries using vegetable oil, and confectionary items, is anticipated to restrain the expansion of the worldwide market.

High Prices May Hamper the Market Growth

A2 butter is produced from A2 milk, which is produced by cows of Indian descent, although less milk is produced per cow. As a result, the gap between supply and demand is created. The difference between the supply and demand for A2 grade milk further drives up the cost of the finished goods such as A2 butter, making A2 butter more expensive than A1 milk. A2 grade milk has a higher total value due to its nutritive qualities, which promotes its use in nutritional items. Cows were used in the domestication process many years ago. Cows, therefore, generated A1 milk. A1 milk from cows is anticipated to be more abundant than A2 beta-casein milk. To make milk accessible to the general people at a reasonable price, the majority of businesses started selling A1 milk as a result. As a result, A2 milk costs more than A1 milk which eventually increases the cost of the other finished goods from A2 milk.

A2 BUTTER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

17.4% |

|

Segments Covered |

By Type, By Distribution Channel, End-User and By Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

VRINDAVAN DAIRY LLP, GOKHETI, ORIGINMILK, NATURE SOUL, OTHERS |

This research report on the A2 butter market has been segmented and sub-segmented based on Type, By Distribution Channel, End-User and By Region.

A2 BUTTER MARKET- BY TYPE

- Salted

- Unsalted

Based on the type, the A2 butter market is segmented into Salted and Unsalted. Due to its widespread use and appeal, the salted variety commands the highest price on the global market. In the retail and foodservice sectors, it is typically offered as packed butter. Compared to unsalted butter, salted A2 butter has a longer shelf life and is simpler to preserve. Additionally, A2 salted butter enhances the product's flavor and texture. The industry is anticipated to develop as a result of the constantly growing distribution channels and the booming online retail sector. Many processed items, including bakery goods, noodles, and spaghetti, use the unsalted variety. Food producers are now seeing a marked rise in the demand for unsalted varieties. The increased use of refined butter in novel food products such as premixes and ready-to-cook dishes is another factor contributing to its rising consumption.

A2 BUTTER MARKET- BY DISTRIBUTION CHANNEL

- Offline

- Online

Based on the type, the A2 butter market is segmented into Online and Offline. The offline segment generated the highest proportion of the A2 butter market by distribution channel. In 2021, more than half of the world's butter market's income came through offline channels. For the purchase of consumer goods, foodstuffs, and dairy products, consumers choose the offline channel more, which is mostly due to a bigger segmental share. Physical quality and authenticity verification are possible through offline means. Customers view offline channels as being more dependable. Additionally, quick access to and searching through stores for different milk products may influence customer behavior and buying attitudes. Additionally, the bulk of retailers offers their goods through offline channels that are widely accessible and have a dependable delivery system.

With a CAGR of 3.5% from 2023 - 2030, the online sector of the market is predicted to develop at the quickest rate. The global e-commerce industry has grown significantly over the past few years, which is accelerating the expansion of this market. This is due in large part to the increasing smartphone penetration rate and increased internet access across the board. Manufacturers of these goods are increasingly selling their items online, either through their websites or through e-commerce sites. For instance, Amul, an Indian company, delivers milk and dairy goods through its mobile application, which will increase demand for the market.

A2 BUTTER MARKET- BY END-USER

- Industrial Processing

- Retail Channels

- Foodservice

Based on the end-user, the A2 butter market is segmented into, Industrial Processing, Retail Channels and Foodservice. The market is dominated by the industrial processing segment. The increased demand for butter across the processed food production industry is the main driver of segmental expansion. A2 butter is a key component used in the confectionery industry. A2 butter demand has eventually grown across the market as a result of manufacturers' rising investments in research and development of innovative confectionary items. Butter is a key component of many baked goods, including bread and cakes. Shortly, market growth is anticipated to be driven by the significantly expanding bakery industry.

Due to their advanced distribution capabilities, retail channels are expanding quickly. For the selling of packaged butter, these channels offer a solid foundation. As a necessity or pastime, consumers today are interested in doing their baking. Due to the home-growing and cooking habits, the packaged butter market has seen a significant increase throughout the epidemic.

A2 BUTTER MARKET- BY REGION

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East

- Africa

By region, the A2 butter market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. Because India is one of the region's top milk producers, Asia Pacific continues to hold the largest market share. The region's expanding consumer spending has fueled an increase in the demand for dairy products. Leading dairy companies are increasing the sales of packaged A2 butter products via clever marketing initiatives. Consumer demand for cooking and baking is rising, which has forced key firms to improve their processing skills to meet the demand.

As a result of the rising demand for clean-label and sustainable milk and dairy products, Europe is predicted to develop at a high CAGR. Europe's economy is mostly driven by customers' rising demand for bread and other bakery goods.

Over the past few years, consumer preferences have evolved toward favoring safer and healthier products. In the next years, the market expansion is anticipated to be driven by the rising demand for butter that is organic and free of genetically modified organisms (GMOs).

The rising demand for processed food items is the main driver of the North American market. The region's growing and changing foodservice industry is a major factor in the demand for butter. Today's consumers in the area are interested in baking at home, which significantly boosts the sale of retail packages. Additionally, the growing popularity of clean-label food goods in the United States has raised the demand for organic butter. The market's top companies are leveraging the rise in demand for inventive, new, and high-end butter products.

The market in South America is expanding significantly as a result of rising consumer discretionary income levels. Among millennials, baked products are growing in popularity. In the upcoming years, regional growth is anticipated to be fueled by the rising demand for confectionery. The Middle East & Africa market is primarily driven by customers' rising appetites for baked goods, candies, and sweets. The region's changing food consumption trends are mostly driven by urbanization and exposure to western cuisine culture.

A2 BUTTER MARKET- BY COMPANIES

Some of the major players operating in the A2 butter market include:

- VRINDAVAN DAIRY LLP

- GOKHETI

- ORIGINMILK

- NATURE SOUL

- OTHERS

NOTABLE HAPPENING IN THE A2 BUTTER MARKET

- PRODUCT LAUNCH- Fonterra's dairy brand NZMP introduced a carbon zero certified organic butter to the North American market in March 2021. It will assist the business in achieving its sustainability goals.

- EXPANSION- Arla Foods said in March 2021 that it will be expanding its Lurpak lighter line with a new lighter butter composed of only butter, water, and salt.

Chapter 1.A2 BUTTER MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.A2 BUTTER MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.A2 BUTTER MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.A2 BUTTER MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. A2 BUTTER MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.A2 BUTTER MARKET – By Type

6.1. Salted

6.2. Unsalted

Chapter 7.A2 BUTTER MARKET – By Distribution Channel

7.1. Offline

7.2. Online

Chapter 8.A2 BUTTER MARKET – By End-User

8.1. Industrial Processing

8.2. Retail Channels

8.3. Foodservice

Chapter 9.A2 BUTTER MARKET – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10.A2 BUTTER MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. VRINDAVAN DAIRY LLP

10.2. GOKHETI

10.3. ORIGINMILK

10.4. NATURE SOUL

10.5. OTHERS

Download Sample

Choose License Type

2500

4250

5250

6900